I will be on vacation and will be back on Wednesday 10/10. Happy trading and invest to all my blog's visitors.

~~~~~~

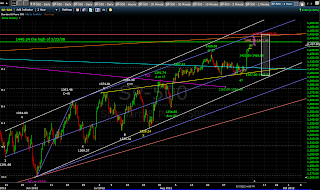

The rise since 1329.24 is clearly motive impulse waves (5-waves non-overlap pattern).

The rise from 1396.56 is likely a wave 5 extended and my target would be 1494.00.

~~~~~~

The pre-market for Monday hints a further pullback of the index after the Friday's high at 1467.07 was made. If the supports 1455.00-1457.00 could work and the index could bounce the next day, it might be an inverted H&S (head and shoulders) pattern. If bears could go further and drive the index down to 1451.75-1446.37, it could be an ABC mode in a bigger frame.

9.24.2012

9.21.2012

Bulls target today would be 1465.00 +/-

The rise since 1329.24 is clearly motive impulse waves (5-waves non-overlap pattern).

The rise from 1396.56 is likely a wave 5 extended and my target would be 1494.00.

~~~~~~

It's very likely the index had finished the ABC mode correction and would pave the way to 1494.00.

I don't rule out a cautious scenario that the index could reach 1469.00 +/-, turn south again to visit 1446.37, then turn north to resume the main trend and finish the target 1494.00.

In any case, my first target for bulls today would be 1465.00 +/-. Bulls need to get there, a minimal pullback then is allowable before the next fight (probably next Monday) for 1469.00.

The rise from 1396.56 is likely a wave 5 extended and my target would be 1494.00.

~~~~~~

It's very likely the index had finished the ABC mode correction and would pave the way to 1494.00.

I don't rule out a cautious scenario that the index could reach 1469.00 +/-, turn south again to visit 1446.37, then turn north to resume the main trend and finish the target 1494.00.

In any case, my first target for bulls today would be 1465.00 +/-. Bulls need to get there, a minimal pullback then is allowable before the next fight (probably next Monday) for 1469.00.

9.20.2012

The pullback from 1474.51 is likely to end in ABC mode

12:05PM Update

So far so good for my plan. Also watching AGQ, the Silver agent.

~~~~~

The rise since 1329.24 is clearly motive impulse waves (5-waves non-overlap pattern).

The rise from 1396.56 is likely a wave 5 extended and my target would be 1494.00.

~~~~~~

The index yesterday made a double top pattern at 1465.15, just a hair missing from the low target 1465.32. The double top pattern is bearish and the pre-market is adding a confirmation to this attribute.

The pullback from 1474.51 is about to resume today which, if can make a lower low than 1456.13 will fit the ABC correction pattern.

I expect the point C of this correction, in a worst case, would be somewhere between 1453.63-1451.75. At this level, the buy on dip would be triggered and the index may end the corrective wave 4/5 to start an impulse wave 5/5 for the target 1494.00.

So far so good for my plan. Also watching AGQ, the Silver agent.

~~~~~

The rise since 1329.24 is clearly motive impulse waves (5-waves non-overlap pattern).

The rise from 1396.56 is likely a wave 5 extended and my target would be 1494.00.

~~~~~~

The index yesterday made a double top pattern at 1465.15, just a hair missing from the low target 1465.32. The double top pattern is bearish and the pre-market is adding a confirmation to this attribute.

The pullback from 1474.51 is about to resume today which, if can make a lower low than 1456.13 will fit the ABC correction pattern.

I expect the point C of this correction, in a worst case, would be somewhere between 1453.63-1451.75. At this level, the buy on dip would be triggered and the index may end the corrective wave 4/5 to start an impulse wave 5/5 for the target 1494.00.

9.19.2012

Bulls would fight for the first target area 1465.32-1467.49

The rise since 1329.24 is clearly motive impulse waves (5-waves non-overlap pattern).

The rise from 1396.56 is likely a wave 5 extended and my target would be 1494.00.

~~~~~

My yesterday's update at 12.46 pm: "Looks like 1456.13 holds. If it can hold till 2.00 PM, I think the pullback was done and We would see the Wednesday in green."

It's very likely that the main bullish trend to resume today and the index's first target area is 1465.32-1467.49.

The very solid support area for the index in a bearish case is 1451.75-1446.37.

Silver

Silver is expected to break out the $35.1559 in next few days.

The rise from 1396.56 is likely a wave 5 extended and my target would be 1494.00.

~~~~~

My yesterday's update at 12.46 pm: "Looks like 1456.13 holds. If it can hold till 2.00 PM, I think the pullback was done and We would see the Wednesday in green."

It's very likely that the main bullish trend to resume today and the index's first target area is 1465.32-1467.49.

The very solid support area for the index in a bearish case is 1451.75-1446.37.

Silver

Silver is expected to break out the $35.1559 in next few days.

9.18.2012

The pullback's target area 1451.75-1446.37 is approaching

12.46 PM Update

Looks like 1456.13 holds. If it can hold till 2.00 PM, I think the pullback was done and We would see the Wednesday in green.

The rise since 1329.24 is clearly motive impulse waves (5-waves non-overlap pattern).

Looks like 1456.13 holds. If it can hold till 2.00 PM, I think the pullback was done and We would see the Wednesday in green.

The rise since 1329.24 is clearly motive impulse waves (5-waves non-overlap pattern).

9.16.2012

A pullback may be imminent

6.26am Update

The pre-market raises the odds of one of the two following scenarios:

The rise since 1329.24 is clearly motive impulse waves (5-waves non-overlap pattern).

The pre-market raises the odds of one of the two following scenarios:

The rise since 1329.24 is clearly motive impulse waves (5-waves non-overlap pattern).

The rise from 1396.56 is likely a wave 5 extended and my target would be 1494.00.

My high odds scenario maintains a push up on Monday to test 1474.51 to take it over and a pullback next. At a higher high of 1474.51 seen, a forcefully selling pressure would present.

Another low odds scenario is a continued pullback on Monday (unsuccessful test 1474.51 to make B from ABC pattern) to test the support 1451.75-1446.37. At this support level I would like to add longs.

9.14.2012

Two more green days (Friday and next Monday)?

The rise since 1329.24 looks motive impulse waves (5 waves non-overlap pattern).

It is likely that the index will make two further green days (Friday and Monday).

Bulls target today may be around 1472.00. A cautious scenario anticipates a pullback after achieving the highest. Today's high would be revisited on Monday and may or not be broken out - That would end wave 3/5 and we may see a pull back then to make wave 4/5.

It is likely that the index will make two further green days (Friday and Monday).

Bulls target today may be around 1472.00. A cautious scenario anticipates a pullback after achieving the highest. Today's high would be revisited on Monday and may or not be broken out - That would end wave 3/5 and we may see a pull back then to make wave 4/5.

9.13.2012

Waiting mode

I guess:

Bullish continuous case targets 1450.00-1460.00 or beyond (needs about 2-3 days) with Catalyst of QE3.

Bearish short-term case targets 1417.00-1418.00 (needs about 2-3 days) upon unsatisfied FED's announcement.

1417.00-1418.00 is expected a buy zone.

Bullish continuous case targets 1450.00-1460.00 or beyond (needs about 2-3 days) with Catalyst of QE3.

Bearish short-term case targets 1417.00-1418.00 (needs about 2-3 days) upon unsatisfied FED's announcement.

1417.00-1418.00 is expected a buy zone.

9.12.2012

SPX

The market was not volatile. It was only calm in a low volume, however it was trying to claim back which it gave up on Monday. Bullish sentiment prevails the market and it is proved right.

A good news for the markets today is German court approves bailout fund, with conditions http://www.guardian.co.uk/business/2012/sep/12/eurozone-crisis-german-court-bailout-fund

The market was not volatile. It was only calm in a low volume, however it was trying to claim back which it gave up on Monday. Bullish sentiment prevails the market and it is proved right.

A good news for the markets today is German court approves bailout fund, with conditions http://www.guardian.co.uk/business/2012/sep/12/eurozone-crisis-german-court-bailout-fund

"By rejecting the complaint,

Germany's constitutional court has given the green light for Germany's

president to sign the €700bn European Stability Mechanism into German

law.

That takes away the danger of the bailout fund being blocked.

But there are also some key conditions:

1) The court has rules that German liability to the ESM must not exceed €190bn without asking the Bundestag for approval.

2) Both houses of the German Parliament must be kept informed about how the funds within the ESM are deployed."

There is no reason not to be bullish now, I think however if FOMC's statement release (12.30pm tomorrow) didn't please the markets, we'd see better chances to buy stocks at better prices. Let's see.

The index maintains 4 days in the upper part of the rising channel.

That takes away the danger of the bailout fund being blocked.

But there are also some key conditions:

1) The court has rules that German liability to the ESM must not exceed €190bn without asking the Bundestag for approval.

2) Both houses of the German Parliament must be kept informed about how the funds within the ESM are deployed."

There is no reason not to be bullish now, I think however if FOMC's statement release (12.30pm tomorrow) didn't please the markets, we'd see better chances to buy stocks at better prices. Let's see.

The index maintains 4 days in the upper part of the rising channel.

9.11.2012

Volatile ahead of the FOMC-meeting?

My pennant-beak-out failed and I have accepted a reality to see a pullback.

I am watching closely the support area 1422.65-1426.68 and the next supports 1417.65

I expect 1412.67 would hold.

I would like to stay outside this market until after the FOMC-meeting (September 12-13).

I am watching closely the support area 1422.65-1426.68 and the next supports 1417.65

I expect 1412.67 would hold.

I would like to stay outside this market until after the FOMC-meeting (September 12-13).

9.09.2012

1450.00 being solid or broken out?

SPX daily

The resistance line (white) that connect 1370.58 to 1422.38 shows the resistance value at 1450.00 for the next few days.

SPX 2-hours chart

The Andrews' Pitchfork (violet) may be more cautious to represent the trend channel that the prices have followed since June 4. The upper trend line hints +1450.00 being a resistance in next few days.

However I don't rule out the possibility that the real trend channel defined by the simple drawing that connect the low of June 4 to the low of July 24 and the high of May 29 to the high of June 19. If this proved more realistic later on, +1450.00 could not be a very solid resistance and bulls would break it out with catalyze of QE3 announcement.

Bulls would target 1445.35 in next one or two days.

A pennant break out (volume confirmed from SPY's chart) seen on the 15min chart and the textbook target is 1445.35.

The resistance line (white) that connect 1370.58 to 1422.38 shows the resistance value at 1450.00 for the next few days.

SPX 2-hours chart

The Andrews' Pitchfork (violet) may be more cautious to represent the trend channel that the prices have followed since June 4. The upper trend line hints +1450.00 being a resistance in next few days.

However I don't rule out the possibility that the real trend channel defined by the simple drawing that connect the low of June 4 to the low of July 24 and the high of May 29 to the high of June 19. If this proved more realistic later on, +1450.00 could not be a very solid resistance and bulls would break it out with catalyze of QE3 announcement.

Bulls would target 1445.35 in next one or two days.

A pennant break out (volume confirmed from SPY's chart) seen on the 15min chart and the textbook target is 1445.35.

9.07.2012

I guess the next target of bulls for today could be 1440.28

Draghi saved the Euro and the stock markets. I think we would see 1450.00 before seeing any meaningful pullback.

I guess the next target of bulls for today could be 1440.28 and I expect to buy the intraday pullbacks.

I don't intend to short before the next week's FOMC-meeting (September 12-13).

I guess the next target of bulls for today could be 1440.28 and I expect to buy the intraday pullbacks.

I don't intend to short before the next week's FOMC-meeting (September 12-13).

9.06.2012

Can gold-rise be a sign for bulls?

I posted a chart of gold on 8/27 when it was at 1670.39 saying "If gold can win 1674.47, next target may be 1690.00." http://cyclestockmarketwinner.blogspot.com/2012/08/bulls-may-try-their-best-for-141575.html

Gold today jumped up to 1709.53 after a 3-days consolidation at 1690. Is gold and silver anticipating something positive for the stock markets?

It looks like Europe markets are rising on bets ECB will announce Bond-Purchase Plan.

We will see whether bulls could enjoy 1410.80-1412.20 before making next trial for 1415.40-1417.30 or bears could break down the 1397.00 on the third try because of nothing new from ECB?

Gold today jumped up to 1709.53 after a 3-days consolidation at 1690. Is gold and silver anticipating something positive for the stock markets?

It looks like Europe markets are rising on bets ECB will announce Bond-Purchase Plan.

We will see whether bulls could enjoy 1410.80-1412.20 before making next trial for 1415.40-1417.30 or bears could break down the 1397.00 on the third try because of nothing new from ECB?

9.05.2012

1397.00 holds the second time and there would be no big bet ahead of the key ECB meeting

Yesterday, the negative bias seen from the Europe markets before the US session open and as a result, the bearish scenario placed in action. The support area 1397.00-1400.00 worked well as where bears satisfy the gain and leaving prices pushed up by the bulls. Bulls have reclaimed almost what bears borrowed for the day.

My favorite scenario for today is bears will try another push down to visit 1402.30-1404.64, this area I expect hold well by bulls and then bulls will fight for the target 1411.85-1413.09.

Bearish case, if any, would be limited by 1397.00-1400.00 because of high chances that no big bet ahead of the key ECB meeting.

My favorite scenario for today is bears will try another push down to visit 1402.30-1404.64, this area I expect hold well by bulls and then bulls will fight for the target 1411.85-1413.09.

Bearish case, if any, would be limited by 1397.00-1400.00 because of high chances that no big bet ahead of the key ECB meeting.

9.03.2012

I guess that markets will continue the rise at least one more day

SPX Short Term

Last Friday, Bernanke didn't hint an imminent stimulus, however the market got a rally and the 1404.64 level now becomes a support.

I guess that markets will continue the rise at least one more day before we may see a consolidation or a down day. An early confirmation signal to what I guess would be a positive bias of Europe markets seen before the US session open.

The bullish scenario will target the area 1415.40-1417.30 and I may expect a pullback middle way in the area 1411.85-1413.09 which however would offer a chance to add long positions.

The bearish scenario would target 1402.30-1404.64 if successful will go next down to 1397.00-1400.00.

SPX Intermediate Term

Looks bullish before a possible bearish ending with the following aspects:

- Most of time since 6/7/2012 the prices are above the MA20.

- The prices are in a rising channel (yellow).

- Bollinger bands are contracting, in this case may hint a spike up later on.

- Looks as in the forming of a Rising Wedge, which eventually will be bearish.

- The last target of bulls may be 1450.00 as the chart anticipate.

- Timing of the bearish reversal may be the end of September.

Acknowledge

Dear Shelli,

Thank you so much for your donation which I believe bring me so much meaning when it happens on the Labor Day occasion and it's the first donation I received from this site. I will keep on my best to make my analysis more objective and more informative for you and all other visitors.

Be safe and successful trader.

Last Friday, Bernanke didn't hint an imminent stimulus, however the market got a rally and the 1404.64 level now becomes a support.

I guess that markets will continue the rise at least one more day before we may see a consolidation or a down day. An early confirmation signal to what I guess would be a positive bias of Europe markets seen before the US session open.

The bullish scenario will target the area 1415.40-1417.30 and I may expect a pullback middle way in the area 1411.85-1413.09 which however would offer a chance to add long positions.

The bearish scenario would target 1402.30-1404.64 if successful will go next down to 1397.00-1400.00.

SPX Intermediate Term

Looks bullish before a possible bearish ending with the following aspects:

- Most of time since 6/7/2012 the prices are above the MA20.

- The prices are in a rising channel (yellow).

- Bollinger bands are contracting, in this case may hint a spike up later on.

- Looks as in the forming of a Rising Wedge, which eventually will be bearish.

- The last target of bulls may be 1450.00 as the chart anticipate.

- Timing of the bearish reversal may be the end of September.

Acknowledge

Dear Shelli,

Thank you so much for your donation which I believe bring me so much meaning when it happens on the Labor Day occasion and it's the first donation I received from this site. I will keep on my best to make my analysis more objective and more informative for you and all other visitors.

Be safe and successful trader.

Subscribe to:

Posts (Atom)