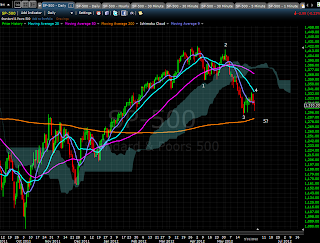

If my favorite scenario becomes truth, the counter trend rally that began from 1266.74 may be a double Zigzag and the [A][B][C] of this rally may end somewhere around [1380.xx - 1389.07].

If price falls hard next Monday that potentially takes away 1334.40, bears may raise the odds that the wave 2 made from ABC (A?B?C? - in my chart) has finished (This case also means [A][B][C] has finished and [C]=1363.46).

SPX hourly

Watching the chart from a bigger time frame, I know that bears should be over if bulls win 1395.00 any day in July.

SPX daily indicators

3 indicators in the chart are bullish. Stochastics looks from neutral to slightly bullish.

SPX medium term: http://cyclestockmarketwinner.blogspot.com/p/spx-medium-term.html

My trading plan

As long as the zone [1380.xx - 1389.07] is still ahead and no deeper than -1% fall seen, long on pullback would be my choice.