7:44 PM Update

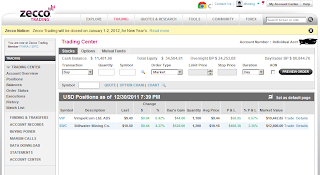

US markets didn't close in green as I suggested. However as I said "Those shallow pullbacks, that 125.40 hold, are considered safe for bulls.". I played longs and I made money that I want to show you in real.

These items I keep over New Year:

These executed items all made money except HAS (HAS lost not much):

Please accept my greeting Happy New Year! to you and your lovely Family.

12:06 PM Update

Europe markets closed in beautifully green. EURUSD is in bouncing mode with some more room ahead. Fairly, US markets should be in green and I expect a close of SPY at about 126.50.

EURUSD is still in bouncing mode from the sharp sell-off on 12/28 and the low made on 12/29. This bounce may be continuing and that in turn supports stock markets for some days more.

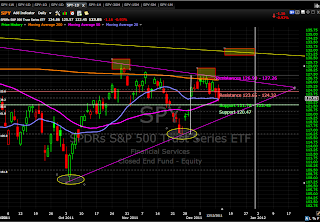

SPY daily showed a nice bounce that pushed the price an inch above the MA200 and above the bearish resistance line 5/2/11-7/7/11 again. That favor the expectation that bulls may want to test the 126.82 or 127.26 before any substantial pullback.

SPY 5min trading range may be limited by boxes (125.40 - 125.78) - (126.33 - 126.82).

My trade setting for 12/30/2011

Those shallow pullbacks, that 125.40 hold, are considered safe for bulls.

12.30.2011

12.29.2011

The bullish setting is under pressure and challenged severely by the fall of EURUSD

10:16AM update

Italy debt cost eased, Europe markets look good, EURUSD is bouncing. I think bulls may get a green light to go.

SPY daily: Doesn't look good for bulls because of this selloff. I dismiss my long target 130 for the week. I tend to think that it was a mark of a reversal.

SPY 5min: Trade zone in combining boxes and symmetrical broadening bottom?

But we may see a different scenario that I will certainly buy at my lowest support level to play the rebound.

My trade setting for 12/30/2011

No more long target 130! Was yesterday selloff a mark of a reversal? Need to watch Europe market.

Bears: Shorts at pullback from resistance box/resistance line of the symmetrical broadening pattern if Europe markets and Italian bond auction today doesn't sound well.

Aggressive Bulls: Long at the lowest level of the support box and hold over weekend if necessary.

Italy debt cost eased, Europe markets look good, EURUSD is bouncing. I think bulls may get a green light to go.

SPY daily: Doesn't look good for bulls because of this selloff. I dismiss my long target 130 for the week. I tend to think that it was a mark of a reversal.

SPY 5min: Trade zone in combining boxes and symmetrical broadening bottom?

But we may see a different scenario that I will certainly buy at my lowest support level to play the rebound.

My trade setting for 12/30/2011

No more long target 130! Was yesterday selloff a mark of a reversal? Need to watch Europe market.

Bears: Shorts at pullback from resistance box/resistance line of the symmetrical broadening pattern if Europe markets and Italian bond auction today doesn't sound well.

Aggressive Bulls: Long at the lowest level of the support box and hold over weekend if necessary.

12.28.2011

Market was in consolidation yesterday. Looks to me that SPY has been forming a symmetrical triangle and trading range today may be limited by boxes (125.70 - 126.08) - (126.74 - 127.10)

10:40 Update

EURUSD deeply dropped and is just seating on the support 1.2950. The SPY sank below my support box. It's not good for bulls and I shift to wait and see mode for today.

SPY daily showed a consolidation with bullish bias.

SPY 30min: Seems that a symmetrical triangle has been forming and the trading range today may be limited by boxes (125.70 - 126.08) - (126.74 - 127.10).

Trade setting for 12/28/2011

Maintain buying on weakness and expect the high-target of the last week of 2011 at about 128-130.

EURUSD deeply dropped and is just seating on the support 1.2950. The SPY sank below my support box. It's not good for bulls and I shift to wait and see mode for today.

SPY daily showed a consolidation with bullish bias.

SPY 30min: Seems that a symmetrical triangle has been forming and the trading range today may be limited by boxes (125.70 - 126.08) - (126.74 - 127.10).

Trade setting for 12/28/2011

Maintain buying on weakness and expect the high-target of the last week of 2011 at about 128-130.

12.26.2011

Bulls clearly have taken the control and may ambitiously advance to 129.42-130.16

SPY daily showed the four consecutive days in green and staying above the MA50. Last Friday the price got through and closed above the conjugation of the MA200 and the Bearish resistance line 7/7/11-7/21/11 and had been advancing almost without considerable pullback intraday. Witnessing a numbers of technical indicators have gotten bullish crossover last three days, I expect the ETF will hold the bullish momentum and be traded in range of 127.26-130.16 for the last week of the year.

SPY 30min trading range (125.68 - 126.00) - (126.71 - 127.16).

Trade setting for 12/27/2011

Except Europe markets drop more than 1.20%, any weakness (better than -1.20%) of SPY will be a chance to buy for long the week maybe until 130.16.

-----------------------------------

Reviewing Trade setting for 12/23/2011

Bulls: Buy the pullback at supports and hold over weekend. => My sense told me the supports might be not reachable. Then I bought at 125.50-125.60 and kept partly over holidays.

Aggressive Bears: Play the pullback for day trade only.

11:29 AM update

Lucky. I did buy the low of the day.

SPY 5min looks breaking out the Ascending Triangle. I think next target may be 126.05 - 126.15.

12.24.2011

Merry Christmas all visitors and your family!

Most important thing, I would like to say Merry Christmas to all visitors and your family!

I hope that you like my blog. If you read my posts these days, you may agree that their quality is improving.

You know? Your visits is always one of my motivation to work better for the blog. Therefore I should appreciate if you would do me a favor by recommending my blog to http://investimonials.com/suggest/

Enjoy your great holidays and wishing you success.

I hope that you like my blog. If you read my posts these days, you may agree that their quality is improving.

You know? Your visits is always one of my motivation to work better for the blog. Therefore I should appreciate if you would do me a favor by recommending my blog to http://investimonials.com/suggest/

Enjoy your great holidays and wishing you success.

12.23.2011

We may see a pullback, however it is a chance to buy.

11:29 AM update

Lucky. I did buy the low of the day.

SPY 5min looks breaking out the Ascending Triangle. I think next target may be 126.05 - 126.15.

SPY daily gives me a very bullish impression with three consecutive days sitting above MA50 and yesterday price began to popup from the Ichimoku Cloud.

The selling pressure may come from the fact that the three consecutive up days could be considered too "stretch" and also the selling may come from the profit-pocketing before long holidays.

SPY 30min shows a symmetrical broadening top is forming that reflects the indecisiveness of the market after the 125.26 achieved.

SPY 30min trading range: Supports 124.36 - 124.80, resistances 126.30 - 126.50

Trade setting for 12/23/2011

Bulls: Buy the pullback at supports and hold over weekend.

Aggressive Bears: Play the pullback for day trade only.

-----------------------------------

Reviewing trade setting for 12/21/2011

My buying zone 122.77 - 123.20. The partial profit taking zone 124.50 -125.55. => Bought 123.00 keep it overnight. => Sold 125.00 scored 2.00.

The buy setting on pullback may be maintained for one week.

Accumulated Score from 11/23/2011: 3.90 + 2.00 = 5.90

Lucky. I did buy the low of the day.

SPY 5min looks breaking out the Ascending Triangle. I think next target may be 126.05 - 126.15.

SPY daily gives me a very bullish impression with three consecutive days sitting above MA50 and yesterday price began to popup from the Ichimoku Cloud.

The selling pressure may come from the fact that the three consecutive up days could be considered too "stretch" and also the selling may come from the profit-pocketing before long holidays.

SPY 30min shows a symmetrical broadening top is forming that reflects the indecisiveness of the market after the 125.26 achieved.

SPY 30min trading range: Supports 124.36 - 124.80, resistances 126.30 - 126.50

Trade setting for 12/23/2011

Bulls: Buy the pullback at supports and hold over weekend.

Aggressive Bears: Play the pullback for day trade only.

-----------------------------------

Reviewing trade setting for 12/21/2011

My buying zone 122.77 - 123.20. The partial profit taking zone 124.50 -125.55. => Bought 123.00 keep it overnight. => Sold 125.00 scored 2.00.

The buy setting on pullback may be maintained for one week.

Accumulated Score from 11/23/2011: 3.90 + 2.00 = 5.90

12.22.2011

I maintain the view to buy any pullback until the targets 126.30-127.16

SPY daily has maintained two days close above the MA50 after bounced from the bullish support line meeting. The intraday buy on pullback was vigorous enough to make the candle stick a very long tail that maintain my bullish impression.

ECB lending to banks (though at an amount exceeding the forecast (€489bn/€300bn)) must be considered as a good news because "The ECB said 523 banks had taken advantage of the scheme that allowed them to offer lower-grade collateral in exchange for loans pegged to the central bank's main interest rate, currently at a record low of 1%. Mario Draghi, the ECB's president, has insisted that no stigma will be attached to banks applying for the loans, which for some is more than three percentage points cheaper than they could obtain on the open market."

SPY 30min serves as day trade targets: 123.40 - 125.55.

My trade setting for 12/22/2011

I maintain the view to buy any pullback until the targets 126.30-127.16.

---------------------------------------

Reviewing trade setting for 12/21/2011

My buying zone 122.77 - 123.20. The partial profit taking zone 124.50 -125.55. => Bought 123.00 keep it overnight.

The buy setting on pullback may be maintained for one week.

ECB lending to banks (though at an amount exceeding the forecast (€489bn/€300bn)) must be considered as a good news because "The ECB said 523 banks had taken advantage of the scheme that allowed them to offer lower-grade collateral in exchange for loans pegged to the central bank's main interest rate, currently at a record low of 1%. Mario Draghi, the ECB's president, has insisted that no stigma will be attached to banks applying for the loans, which for some is more than three percentage points cheaper than they could obtain on the open market."

SPY 30min serves as day trade targets: 123.40 - 125.55.

My trade setting for 12/22/2011

I maintain the view to buy any pullback until the targets 126.30-127.16.

---------------------------------------

Reviewing trade setting for 12/21/2011

My buying zone 122.77 - 123.20. The partial profit taking zone 124.50 -125.55. => Bought 123.00 keep it overnight.

The buy setting on pullback may be maintained for one week.

12.21.2011

The big rebound seen may mark a trend change. The pullback may be the chance to buy for this week.

11:20 AM Update

SPY is about 123.02. I think it is time to add longs.

SPY daily got a strong rebound from the bullish support line. With this rebound erasing 5 last down days, I tend to think that a reversal is starting and my setting will point to buy on pullback. The bullish is supported by improved US economic data, German business sentiment rose, Euro bonds interest eased, Santa rally statistic and technical supports.

SPY 30min: My buying zone 122.77 - 123.20. The partial profit taking zone 124.50 -125.55.

My trade setting for 12/21/2011

My buying zone 122.77 - 123.20. The partial profit taking zone 124.50 -125.55.

The buy setting on pullback may be maintained for one week.

SPY is about 123.02. I think it is time to add longs.

SPY daily got a strong rebound from the bullish support line. With this rebound erasing 5 last down days, I tend to think that a reversal is starting and my setting will point to buy on pullback. The bullish is supported by improved US economic data, German business sentiment rose, Euro bonds interest eased, Santa rally statistic and technical supports.

SPY 30min: My buying zone 122.77 - 123.20. The partial profit taking zone 124.50 -125.55.

My trade setting for 12/21/2011

My buying zone 122.77 - 123.20. The partial profit taking zone 124.50 -125.55.

The buy setting on pullback may be maintained for one week.

12.20.2011

A rebound is technically expected

11:56 AM Update

If SPY can close above 122.80, then today may be the day marking trend change.

SPY daily shows that the price is seated on the confluence of Fib61.8 and the bullish support line of the triangle. With the EURUSD up 0.58% and most of Europe indexes are bouncing up. We can expect that US market could enjoy a good bounce today.

SPY 30min: Day trade will be in the range of 120.33 - (121.75-122.35) for a rebound and 10.33 - (120.03 - 119.38) for a downtrend continuation.

My trade setting for 12/20/2011

Bulls: Buy if 3 of 4 major Europe indexes (EURUSD, CAC 40, DAX, FTSE 100) are green and that one if sinks, not deeper than -0.25% and SPY opens in green or just in slight red (> -0.25%). Target 121.75-122.35.

Bears: Short if 3 of 4 major Europe indexes (EURUSD, CAC 40, DAX, FTSE 100) are red and that one if green, not more than 0.25% and SPY opens in red. Target 119.38

If SPY can close above 122.80, then today may be the day marking trend change.

SPY daily shows that the price is seated on the confluence of Fib61.8 and the bullish support line of the triangle. With the EURUSD up 0.58% and most of Europe indexes are bouncing up. We can expect that US market could enjoy a good bounce today.

SPY 30min: Day trade will be in the range of 120.33 - (121.75-122.35) for a rebound and 10.33 - (120.03 - 119.38) for a downtrend continuation.

My trade setting for 12/20/2011

Bulls: Buy if 3 of 4 major Europe indexes (EURUSD, CAC 40, DAX, FTSE 100) are green and that one if sinks, not deeper than -0.25% and SPY opens in green or just in slight red (> -0.25%). Target 121.75-122.35.

Bears: Short if 3 of 4 major Europe indexes (EURUSD, CAC 40, DAX, FTSE 100) are red and that one if green, not more than 0.25% and SPY opens in red. Target 119.38

12.16.2011

Market may try to find short term bottom

SPY daily found a support from the Fib50 and got a rebound. This rebound, if can maintain one more day, may be a mark of the reversal and will favor the so called seasonal rally. It seems to me that bears is losing the control soon.

SPY 30min serves as a trading purpose.

My trade setting for 12/16/2011

It seems to me that the selling pressure is reduced.

Bulls: Buy if 3 of 4 major Europe indexes (EURUSD, CAC 40, DAX, FTSE 100) are green and that one if sinks, not deeper than -0.25% and SPY opens in green or just in slight red (> -0.25%). Target 123.20- 123.64.

Aggressive Bulls: May consider to long overnight if 3 major US indexes close in green.

Bears: Short if 3 of 4 major Europe indexes (EURUSD, CAC 40, DAX, FTSE 100) are red and that one if green, not more than 0.25% and SPY opens in red. Target 120.52

Aggressive Bears: May short at a pullback from 123.64 or above.

------------------------------------------

My trade setting for 12/15/2011

Bulls: Buy if 3 of 4 major Europe indexes (EURUSD, CAC 40, DAX, FTSE 100) are green and that one if sinks, not deeper than -0.25% and SPY opens in green or just in slight red (> -0.25%). Target 122.60 - 123.22. => Open gap up to 123.06 meant target met at open. So logically bulls had to sell (if longs were available) or had to wait for a pullback to enter longs.

Aggressive Bears: May short at a return down from 123.22 or above.

Cautious Bears: In waiting mode.

SPY 30min serves as a trading purpose.

My trade setting for 12/16/2011

It seems to me that the selling pressure is reduced.

Bulls: Buy if 3 of 4 major Europe indexes (EURUSD, CAC 40, DAX, FTSE 100) are green and that one if sinks, not deeper than -0.25% and SPY opens in green or just in slight red (> -0.25%). Target 123.20- 123.64.

Aggressive Bulls: May consider to long overnight if 3 major US indexes close in green.

Bears: Short if 3 of 4 major Europe indexes (EURUSD, CAC 40, DAX, FTSE 100) are red and that one if green, not more than 0.25% and SPY opens in red. Target 120.52

Aggressive Bears: May short at a pullback from 123.64 or above.

------------------------------------------

My trade setting for 12/15/2011

Bulls: Buy if 3 of 4 major Europe indexes (EURUSD, CAC 40, DAX, FTSE 100) are green and that one if sinks, not deeper than -0.25% and SPY opens in green or just in slight red (> -0.25%). Target 122.60 - 123.22. => Open gap up to 123.06 meant target met at open. So logically bulls had to sell (if longs were available) or had to wait for a pullback to enter longs.

Aggressive Bears: May short at a return down from 123.22 or above.

Cautious Bears: In waiting mode.

12.15.2011

Be ready to trade a bounce.

SPY is trading in the triangle and is not yet meeting the three months support line. This assumes that the bearish may continue. Many indexes of the 30min chart however show bullish divergence or bullish crossover and that may accommodate a bounce.

My trade setting for 12/15/2011

Bulls: Buy if 3 of 4 major Europe indexes (EURUSD, CAC 40, DAX, FTSE 100) are green and that one if sinks, not deeper than -0.25% and SPY opens in green or just in slight red (> -0.25%). Target 122.60 - 123.22.

Aggressive Bears: May short at a return down from 123.22 or above.

Cautious Bears: In waiting mode.

--------------------------------------------

Reviewing the Trade Setting for 12/14/2011

My basket of indexes is now: EURUSD, CAC 40, DAX, FTSE 100

Bulls: May be in waiting mode.

Bears: Short if 3 of the 4 indexes above are red and pay attention to R/S levels. => Shorted 122.60 covered 122.00 scored 0.60.

Accumulated Score from 11/23/2011: 3.30 + 0.60 = 3.90

My trade setting for 12/15/2011

Bulls: Buy if 3 of 4 major Europe indexes (EURUSD, CAC 40, DAX, FTSE 100) are green and that one if sinks, not deeper than -0.25% and SPY opens in green or just in slight red (> -0.25%). Target 122.60 - 123.22.

Aggressive Bears: May short at a return down from 123.22 or above.

Cautious Bears: In waiting mode.

--------------------------------------------

Reviewing the Trade Setting for 12/14/2011

My basket of indexes is now: EURUSD, CAC 40, DAX, FTSE 100

Bulls: May be in waiting mode.

Bears: Short if 3 of the 4 indexes above are red and pay attention to R/S levels. => Shorted 122.60 covered 122.00 scored 0.60.

Accumulated Score from 11/23/2011: 3.30 + 0.60 = 3.90

12.14.2011

"Dec. 8, 2011 could be the mark of a trend change" seems to be confirmed.

11:48 AM update

And pay attention to that EUR/USD hourly bounced from 1.2951 support.

Loaded TNA @39.30

10:17 AM update

Shorted 122.60 covered 122.00. Accept to be a dime picker these day.

SPY daily made a new low in 10 days. The gathering points of MA20 and MA50 (122.71/85) were tested and held, however they are expected to be tested again today. If MA50 cannot hold today, my suggestion:

"The price drop on Dec. 8, 2011 could be the mark of a trend change." will be confirmed.

SPY 30min: The support 123.09 broken and yesterday low was 122.45 showed Bears were ready to increase the selling pressure at the 125.22 (the high level of resistance). 125.22 could only hold for 45 minutes!

The volatility is expected to reduce when we are coming nearer to the nose of the wedge until we see a break down or break out.

My Trade Setting for 12/14/2011

My basket of indexes is now: EURUSD, CAC 40, DAX, FTSE 100

Bulls: May be in waiting mode.

Bears: Short if 3 of the 4 indexes above are red and pay attention to R/S levels.

------------------------------------------

Reviewing the Trade Setting for 12/13/2011

Bulls: Buy if 2 of 3 major Europe indexes (CAC 40, DAX, FTSE 100) are green more than 0.00% and the third if sinks, not deeper than -0.25% and SPY opens in green or just in slight red (> -0.25%). => Bought 124.90 sold 125.30 scored 0.40.

Bears: Short if 3 major Europe indexes sink and 2 of them sink more than -0.50% and SPY sink more than -0.50%

Accumulated Score from 11/23/2011: 2.90 + 0.40 = 3.30

SPY: I see the 7-th red bars in the hourly chart and I think I need to perusal again Cobras statistic Dec 8 recently.

And pay attention to that EUR/USD hourly bounced from 1.2951 support.

Loaded TNA @39.30

10:17 AM update

Shorted 122.60 covered 122.00. Accept to be a dime picker these day.

SPY daily made a new low in 10 days. The gathering points of MA20 and MA50 (122.71/85) were tested and held, however they are expected to be tested again today. If MA50 cannot hold today, my suggestion:

"The price drop on Dec. 8, 2011 could be the mark of a trend change." will be confirmed.

SPY 30min: The support 123.09 broken and yesterday low was 122.45 showed Bears were ready to increase the selling pressure at the 125.22 (the high level of resistance). 125.22 could only hold for 45 minutes!

The volatility is expected to reduce when we are coming nearer to the nose of the wedge until we see a break down or break out.

My Trade Setting for 12/14/2011

My basket of indexes is now: EURUSD, CAC 40, DAX, FTSE 100

Bulls: May be in waiting mode.

Bears: Short if 3 of the 4 indexes above are red and pay attention to R/S levels.

------------------------------------------

Reviewing the Trade Setting for 12/13/2011

Bulls: Buy if 2 of 3 major Europe indexes (CAC 40, DAX, FTSE 100) are green more than 0.00% and the third if sinks, not deeper than -0.25% and SPY opens in green or just in slight red (> -0.25%). => Bought 124.90 sold 125.30 scored 0.40.

Bears: Short if 3 major Europe indexes sink and 2 of them sink more than -0.50% and SPY sink more than -0.50%

Accumulated Score from 11/23/2011: 2.90 + 0.40 = 3.30

12.13.2011

Up, down, up, down we counted 4 days, all huge! Can this repeats today?

SPY 30min: My trading range seems from (122.90 - 123.09) to (124.68 - 125.22). I give a bounce higher odds for Dec 13, 2011 and will seek chances to buy instead of short if my trade setting triggered.

My Trade Setting for 12/13/2011

Bulls: Buy if 2 of 3 major Europe indexes (CAC 40, DAX, FTSE 100) are green more than 0.00% and the third if sinks, not deeper than -0.25% and SPY opens in green or just in slight red (> -0.25%).

Bears: Short if 3 major Europe indexes sink and 2 of them sink more than -0.50% and SPY sink more than -0.50%.

Bulls: Buy if 3 major Europe index are green more than 0.5% (CAC 40, DAX, FTSE 100) and SPY opens in green or just in slight red (> -0.50).

Bears: Short if 3 major Europe index and SPY are diving more than -0.50. => Short 124.80 covered 124.00 scored 0.80.

Accumulated Score from 11/23/2011: 2.10 + 0.80 = 2.90.

My Trade Setting for 12/13/2011

Bulls: Buy if 2 of 3 major Europe indexes (CAC 40, DAX, FTSE 100) are green more than 0.00% and the third if sinks, not deeper than -0.25% and SPY opens in green or just in slight red (> -0.25%).

Bears: Short if 3 major Europe indexes sink and 2 of them sink more than -0.50% and SPY sink more than -0.50%.

Reviewing the Game Setting for Monday 12/12/1011

I am slightly bullish to neutral until I hear a good new from S&P. A bad new from him would favor a pullback.Bulls: Buy if 3 major Europe index are green more than 0.5% (CAC 40, DAX, FTSE 100) and SPY opens in green or just in slight red (> -0.50).

Bears: Short if 3 major Europe index and SPY are diving more than -0.50. => Short 124.80 covered 124.00 scored 0.80.

Accumulated Score from 11/23/2011: 2.10 + 0.80 = 2.90.

12.10.2011

Bulls were pretty strong that they may make a higher high by next Monday

12:55 PM update

The support 123.09 has been held for 1 hour. This support is the gathering point of MA20 and Fib38.2. I think it may be safe to make pilot long. I bought EDC @73.04.

SPY daily: From a big picture, we can see the resistance to the upside is about 126.90 from the downtrend line connecting highs of 7/7 and 7/22 unsuccessfully tested on 10/27 and 12/7.

A hope for the seasonal year-end rally can only supported if bulls win the high of 12/7 at 127.26

On the downside move, bears will face the supports from the 12/8 low and fib levels of the rebound from 11/25-12/7 which are 123.65, 123.09, 121.78, 120.47.

Bullish supports:

- European leaders end Brussels summit with treaty deal. That says a highly consensus for a radical long term solution to fix the debt crisis is found.

- ECB took steps Thursday to ease credit conditions for troubled eurozone banks.

- Effect of Seasonal year-end rally benefit and mood.

Bearish risks:

- The recent threat to downgrade Eurozone sovereign ratings including Germany and France of Standard and Poor's.

- Eurozone banks are facing problems of liquidity when the shortfall capital is revised up to €115bn from €106bn of stress tests in October.

My viewpoint:

- Markets these days seem be driven more by news than by technical TA.

- If the Brussels summit deals could satisfy Standard & Poor's and they decide to suspend their downgrade process, that would be a very good new for bulls for the next week.

- I am slightly bullish to neutral until I hear a good new from S&P. A bad new from him would favor a pullback.

My Game Setting for Monday 12/12/1011

I am slightly bullish to neutral until I hear a good new from S&P. A bad new from him would favor a pullback.

Bulls: Buy if 3 major Europe index are green more than 0.5% (CAC 40, DAX, FTSE 100) and SPY opens in green or just in slight red (> -0.50)

Bears: Short if 3 major Europe index and SPY are diving more than -0.50.

Reviewing the Game Setting for Friday 12/9/2011

My view is that the bullish short term trend might have changed. Therefore, I will consider any bounce as a chance to short. However I may also try a bounce at an important support.

Bears: Short till 123.20 met. Short again at a bounce. => Bad setting! Short @125.20 covered @125.80

Aggressive Bulls: Buy if 123.20 hold well

Accumulated Score from 11/23/2011: 2.70 - 0.60 = 2.10

My mistake is illustrated in the chat below

The support 123.09 has been held for 1 hour. This support is the gathering point of MA20 and Fib38.2. I think it may be safe to make pilot long. I bought EDC @73.04.

SPY daily: From a big picture, we can see the resistance to the upside is about 126.90 from the downtrend line connecting highs of 7/7 and 7/22 unsuccessfully tested on 10/27 and 12/7.

A hope for the seasonal year-end rally can only supported if bulls win the high of 12/7 at 127.26

On the downside move, bears will face the supports from the 12/8 low and fib levels of the rebound from 11/25-12/7 which are 123.65, 123.09, 121.78, 120.47.

Bullish supports:

- European leaders end Brussels summit with treaty deal. That says a highly consensus for a radical long term solution to fix the debt crisis is found.

- ECB took steps Thursday to ease credit conditions for troubled eurozone banks.

- Effect of Seasonal year-end rally benefit and mood.

Bearish risks:

- The recent threat to downgrade Eurozone sovereign ratings including Germany and France of Standard and Poor's.

- Eurozone banks are facing problems of liquidity when the shortfall capital is revised up to €115bn from €106bn of stress tests in October.

My viewpoint:

- Markets these days seem be driven more by news than by technical TA.

- If the Brussels summit deals could satisfy Standard & Poor's and they decide to suspend their downgrade process, that would be a very good new for bulls for the next week.

- I am slightly bullish to neutral until I hear a good new from S&P. A bad new from him would favor a pullback.

My Game Setting for Monday 12/12/1011

I am slightly bullish to neutral until I hear a good new from S&P. A bad new from him would favor a pullback.

Bulls: Buy if 3 major Europe index are green more than 0.5% (CAC 40, DAX, FTSE 100) and SPY opens in green or just in slight red (> -0.50)

Bears: Short if 3 major Europe index and SPY are diving more than -0.50.

Reviewing the Game Setting for Friday 12/9/2011

My view is that the bullish short term trend might have changed. Therefore, I will consider any bounce as a chance to short. However I may also try a bounce at an important support.

Bears: Short till 123.20 met. Short again at a bounce. => Bad setting! Short @125.20 covered @125.80

Aggressive Bulls: Buy if 123.20 hold well

Accumulated Score from 11/23/2011: 2.70 - 0.60 = 2.10

My mistake is illustrated in the chat below

12.09.2011

The price drop on Dec. 8, 2011 could be the mark of a trend change.

12:33 PM Update

Bull seems very strong. There is no substantial pullback till now. Europe markets looks encouraging. If 125.40/50 can be hold, the green of US-Markets may be seen one more in next Monday.

SPY daily may show that the monthly bearish trend-line remains the cap of the mini bullish trend or rebound that developed from Oct. 4 till Dec. 7, 2011.

My Game Setting for 12/9/2011

My view is that the bullish short term trend might have changed. Therefore, I will consider any bounce as a chance to short. However I may also try a bounce at an important support.

Bears: Short till 123.20 met. Short again at a bounce.

Aggressive Bulls: Buy if 123.20 hold well

Scenario and Setting is illustrated in the SPY 30min chart:

Reviewing Game Setting for Thursday 12/08/1011

I maintain to favor Bulls 60% against Bears 40% for this week.

Bulls: Buy on dips/pullback was proved profitable last 3 days and it may be continued today. => Bad call. Bought @125.60 cut loss @125.00

Bears: Be cautious in front of Euro Summit.

Accumulated Score from 11/23/2011: 3.30 - 0.60 = 2.70

Bull seems very strong. There is no substantial pullback till now. Europe markets looks encouraging. If 125.40/50 can be hold, the green of US-Markets may be seen one more in next Monday.

SPY daily may show that the monthly bearish trend-line remains the cap of the mini bullish trend or rebound that developed from Oct. 4 till Dec. 7, 2011.

My Game Setting for 12/9/2011

My view is that the bullish short term trend might have changed. Therefore, I will consider any bounce as a chance to short. However I may also try a bounce at an important support.

Bears: Short till 123.20 met. Short again at a bounce.

Aggressive Bulls: Buy if 123.20 hold well

Scenario and Setting is illustrated in the SPY 30min chart:

Reviewing Game Setting for Thursday 12/08/1011

I maintain to favor Bulls 60% against Bears 40% for this week.

Bulls: Buy on dips/pullback was proved profitable last 3 days and it may be continued today. => Bad call. Bought @125.60 cut loss @125.00

Bears: Be cautious in front of Euro Summit.

Accumulated Score from 11/23/2011: 3.30 - 0.60 = 2.70

12.08.2011

We may see a geen day today

11:39 AM Update

I am very sure that I had made a bad call today. Market is driven by news and policies that the TA couldn't uncover. I close all my longs with loss

Reviewing Game Setting for Wednesday 12/07/2011

I maintain to favor Bulls 60% against Bears 40% for this week. => Closed in green. Bulls are in control.

Bullish scenario:

Bulls: Long and watch for resistances 128.02 - 128.40

Bearish scenario:

Bears: Short and watch for supports 125.40 - 124.54

It still was a day to win for those who could buy on dips. However, the gaped down open was that I meant Bearish scenario. That's why my Game Setting was a bit confused.

EURUSD: The relevance of this pair with US-stock markets may become less rational in the coming time (That was what we saw yesterday) if the following things happens: ECB cuts rate and ECB increases it's bonds buying participation. Therefore I will no more use EURUSD as a tool to support my US-stock markets forecast

SPY 30': Seems that an Ascending Broadening Wedge is forming. I tend to think a green day can be seen today.

My Game Setting for Thursday 12/08/1011

I maintain to favor Bulls 60% against Bears 40% for this week.

Bulls: Buy on dips/pullback was proved profitable last 3 days and it may be continued today.

Bears: Be cautious in front of Euro Summit.

I am very sure that I had made a bad call today. Market is driven by news and policies that the TA couldn't uncover. I close all my longs with loss

Reviewing Game Setting for Wednesday 12/07/2011

I maintain to favor Bulls 60% against Bears 40% for this week. => Closed in green. Bulls are in control.

Bullish scenario:

Bulls: Long and watch for resistances 128.02 - 128.40

Bearish scenario:

Bears: Short and watch for supports 125.40 - 124.54

It still was a day to win for those who could buy on dips. However, the gaped down open was that I meant Bearish scenario. That's why my Game Setting was a bit confused.

EURUSD: The relevance of this pair with US-stock markets may become less rational in the coming time (That was what we saw yesterday) if the following things happens: ECB cuts rate and ECB increases it's bonds buying participation. Therefore I will no more use EURUSD as a tool to support my US-stock markets forecast

SPY 30': Seems that an Ascending Broadening Wedge is forming. I tend to think a green day can be seen today.

My Game Setting for Thursday 12/08/1011

I maintain to favor Bulls 60% against Bears 40% for this week.

Bulls: Buy on dips/pullback was proved profitable last 3 days and it may be continued today.

Bears: Be cautious in front of Euro Summit.

12.07.2011

Hope and Optimism may lift the SPX above the 200 days MA

Reviewing my Game Setting for Tuesday 12/06/2011

I maintain to favor Bulls 60% against Bears 40% for this week. => So far so good.

Open red scenario:

Bears: Short on the way down to 124.25 - 123.65

Aggressive Bulls: Buy on dips => Those who bought on dips (didn't care how the market opened) made quite a good profit .

Cautious Bulls: Off for one day

Open green scenario:

Bulls: Long on the way up to 127.10 - 127.70 => Bought 126.40 sold 126.90 scored +0.50

Accumulated Score from 11/23/2011: 2.80 + 0.50 = 3.30

1. EURUSD daily may be in the forming of a rising wedge. In this case 1.3567 must be overcame, however the first target for today or tomorrow should be about 1.3504 as the neck line. The RSI, MACD and some other indicators are showing bullishness which favors US stock markets.

2. SPY 30min: Seems a rising channel is in forming. It will be confirmed if a jump up at open and no pullback below 126.45 and a day close above 127.12 are seen.

3. My Game Setting for Wednesday 12/07/2011

I maintain to favor Bulls 60% against Bears 40% for this week.

Bullish scenario:

Bulls: Long and watch for resistances 128.02 - 128.40

Bearish scenario:

Bears: Short and watch for supports 125.40 - 124.54

I maintain to favor Bulls 60% against Bears 40% for this week. => So far so good.

Open red scenario:

Bears: Short on the way down to 124.25 - 123.65

Aggressive Bulls: Buy on dips => Those who bought on dips (didn't care how the market opened) made quite a good profit .

Cautious Bulls: Off for one day

Open green scenario:

Bulls: Long on the way up to 127.10 - 127.70 => Bought 126.40 sold 126.90 scored +0.50

Accumulated Score from 11/23/2011: 2.80 + 0.50 = 3.30

1. EURUSD daily may be in the forming of a rising wedge. In this case 1.3567 must be overcame, however the first target for today or tomorrow should be about 1.3504 as the neck line. The RSI, MACD and some other indicators are showing bullishness which favors US stock markets.

2. SPY 30min: Seems a rising channel is in forming. It will be confirmed if a jump up at open and no pullback below 126.45 and a day close above 127.12 are seen.

3. My Game Setting for Wednesday 12/07/2011

I maintain to favor Bulls 60% against Bears 40% for this week.

Bullish scenario:

Bulls: Long and watch for resistances 128.02 - 128.40

Bearish scenario:

Bears: Short and watch for supports 125.40 - 124.54

12.06.2011

We may see a red day today however Bulls will fight tomorrow.

Reviewing my Game Setting for Monday 12/05/2011

Asia and Europe markets are welcoming the Italian austerity plan and I expect the same thing may happen to US markets today. However some caution may need before the press conference of Sarkozy and Merkel meeting in Paris today. => Positive reaction against the Sarkozy and Merkel meeting and Italy austerity plan. The pullback caused by S&P warning to downgrade 17 Euro nations.

I tend to favor Bulls 60% against Bears 40% for this week.

Bulls: Long on the way up to test 126.50 - 126.70 -1 28.40 => Bulls controlled the markets till 13:00PM. Bought 126.60 sold 127.10 scored +0.50.

Bears: Short on the way down to test 123.80 - 123.18

Accumulated Score from 11/23/2011: 2.30 + 0.50 = 2.80

1. EURUSD hourly slight green at the moment but I think it may turn red to test the support line of the rising channel.

2. SPY daily: Some indicators considered to approach the overbought however most of them not yet. I think Bulls still have room to advance.

3. SPY 30min: The pullback from 13:00 PM yesterday may continue for today. However, if Support 123.65 holds, then Bulls may fight back tomorrow.

4. My Game Setting for Tuesday 12/06/2011

I maintain to favor Bulls 60% against Bears 40% for this week.

Open red scenario:

Bears: Short on the way down to 124.25 - 123.65

Aggressive Bulls: Buy on dips

Cautious Bulls: Off for one day

Open green scenario:

Bulls: Long on the way up to 127.10 - 127.70

Asia and Europe markets are welcoming the Italian austerity plan and I expect the same thing may happen to US markets today. However some caution may need before the press conference of Sarkozy and Merkel meeting in Paris today. => Positive reaction against the Sarkozy and Merkel meeting and Italy austerity plan. The pullback caused by S&P warning to downgrade 17 Euro nations.

I tend to favor Bulls 60% against Bears 40% for this week.

Bulls: Long on the way up to test 126.50 - 126.70 -1 28.40 => Bulls controlled the markets till 13:00PM. Bought 126.60 sold 127.10 scored +0.50.

Bears: Short on the way down to test 123.80 - 123.18

Accumulated Score from 11/23/2011: 2.30 + 0.50 = 2.80

1. EURUSD hourly slight green at the moment but I think it may turn red to test the support line of the rising channel.

2. SPY daily: Some indicators considered to approach the overbought however most of them not yet. I think Bulls still have room to advance.

3. SPY 30min: The pullback from 13:00 PM yesterday may continue for today. However, if Support 123.65 holds, then Bulls may fight back tomorrow.

4. My Game Setting for Tuesday 12/06/2011

I maintain to favor Bulls 60% against Bears 40% for this week.

Open red scenario:

Bears: Short on the way down to 124.25 - 123.65

Aggressive Bulls: Buy on dips

Cautious Bulls: Off for one day

Open green scenario:

Bulls: Long on the way up to 127.10 - 127.70

12.02.2011

Bears don't want to sleep and Bulls may take a break next Monday.

Reviewing Game Setting for Fr 12/02/2011

I expect some kind of continuous rally based on hopes before the Dec 8 ECB, Dec 9 Euro summit and Dec 13 FOMC. For my short term trading purpose my first care are the support 123.00 and the resistance zone 126.70-128.40.

Bulls: in action with first targets 126.70-128.40. => Bought 125.80 sold 126.30 made +0.50.

Bears: may have enough time to enjoy the short term hibernation. => No, Bears want to fight!

Accumulated Score from 11/23/2011: 1.80 + 0.50 = 2.30

11:05 AM update

1. SPY talk: The selling pressure came @126.50 at 10:25 a bit early before my resistance low target @126.70. The price then just dropped and dropped further without any bounce. That can be translated as most of Bulls might want to take profit and very few Bulls left to believe a next green day.

The bearish scenario we may see 123.80 and 123.18 be tested.

The bullish scenario we may see 126.50 be retested.

2. Bullish supports:

- US Non-farm Payrolls improvement and Unemployment reduced to 8.6% from 9.0%.

- Some kind of hopes before the Dec 8 ECB, Dec 9 Euro summit and Dec 13 FOMC.

- Technically there must be some more room ahead for bulls to advance because overbought conditions are not seen yet.

3. Bearrish supports:

I expect some kind of continuous rally based on hopes before the Dec 8 ECB, Dec 9 Euro summit and Dec 13 FOMC. For my short term trading purpose my first care are the support 123.00 and the resistance zone 126.70-128.40.

Bulls: in action with first targets 126.70-128.40. => Bought 125.80 sold 126.30 made +0.50.

Bears: may have enough time to enjoy the short term hibernation. => No, Bears want to fight!

Accumulated Score from 11/23/2011: 1.80 + 0.50 = 2.30

11:05 AM update

Bulls may take a break next Monday. >> Wait and see.

The bearish scenario we may see 123.80 and 123.18 be tested.

The bullish scenario we may see 126.50 be retested.

2. Bullish supports:

- US Non-farm Payrolls improvement and Unemployment reduced to 8.6% from 9.0%.

- Some kind of hopes before the Dec 8 ECB, Dec 9 Euro summit and Dec 13 FOMC.

- Technically there must be some more room ahead for bulls to advance because overbought conditions are not seen yet.

3. Bearrish supports:

- Euro zone leaders have spent too long time seeking for a viable solution for the debt crisis and there remain uncertainties about how the crisis can be solved. That is eroding the confidence of the markets participants in the context of Euro zone showing signs of a recession.

- Investors and lenders want a quick fix of the debt crisis. They want to see sustainable debt costs so that their money can be back from sovereign debt with minimal loss. By the common concepts at the moment, that can only be achieved with some kind of bailout or Eurobonds or ECB as a lender of last resort.

- Merkel, the decisive voice of the powerhouse, doesn’t want bailouts, neither Eurobonds nor ECB as last resort lender but thinks that Euro zone can win back the market confidence by applying the austerity and reform on the trouble debtors incorporated with altering Europe's treaties in real fiscal discipline.

- If a compromise solution can not find in coming days, debt costs may spike up again, and markets may sink as a way to continuously pricing in the foretold insolvency.

10:50-11:10PM Update:

A good sign from Italy (TheGuardian).

Italian cabinet was meeting on Sunday to approve austerity measures aimed at restoring it’s credibility in the market.

Their emergency budget, worth a reported €24bn, is hoping to rush the measures through parliament before the EU summit begins on Thursday.

The cabinet was apparently considering:

- a rise in income tax for high earners,

- an increase in VAT of up to two percentage points,

- the restoration of property tax on first homes and new levies on yachts, helicopters and other luxury assets.

- plans to push back the retirement age, and

- to ban cash payments above €1,000 as a contribution to curbing tax evasion.

Asia Markets are showing some slightly positive signs.

EURUSD +0.21% is showing a slightly green.

4:00AM Update:

Europe markets are all in mildly green.

10:50-11:10PM Update:

A good sign from Italy (TheGuardian).

Italian cabinet was meeting on Sunday to approve austerity measures aimed at restoring it’s credibility in the market.

Their emergency budget, worth a reported €24bn, is hoping to rush the measures through parliament before the EU summit begins on Thursday.

The cabinet was apparently considering:

- a rise in income tax for high earners,

- an increase in VAT of up to two percentage points,

- the restoration of property tax on first homes and new levies on yachts, helicopters and other luxury assets.

- plans to push back the retirement age, and

- to ban cash payments above €1,000 as a contribution to curbing tax evasion.

Asia Markets are showing some slightly positive signs.

EURUSD +0.21% is showing a slightly green.

4:00AM Update:

Europe markets are all in mildly green.

EURUSD +0.25%

4. My Game Setting for Monday 12/05/2011

Asia and Europe markets are welcoming the Italian austerity plan and I expect the same thing may happen to US markets today. However some caution may need before the press conference of Sarkozy and Merkel meeting in Paris today.

I tend to favor Bulls 60% against Bears 40% for this week.

Bulls: Long on the way up to test 126.50 - 126.70 -1 28.40

Bears: Short on the way down to test 123.80 - 123.18

11:03 Update

SPY seems behaving some pull back. Any way, I already closed all my longs and have to go to bed. I favor Bulls however some caution may need before the press conference of Sarkozy and Merkel meeting in Paris today.

My activities today:

4. My Game Setting for Monday 12/05/2011

Asia and Europe markets are welcoming the Italian austerity plan and I expect the same thing may happen to US markets today. However some caution may need before the press conference of Sarkozy and Merkel meeting in Paris today.

I tend to favor Bulls 60% against Bears 40% for this week.

Bulls: Long on the way up to test 126.50 - 126.70 -1 28.40

Bears: Short on the way down to test 123.80 - 123.18

11:03 Update

SPY seems behaving some pull back. Any way, I already closed all my longs and have to go to bed. I favor Bulls however some caution may need before the press conference of Sarkozy and Merkel meeting in Paris today.

My activities today:

US Markets Reading Bullish Supported by EURUSD and Global Markets

11:05 AM

Bulls may take a break next Monday.Review My Game Setting For Th 12/1/2011

Bulls: Buy on pullbacks. Target 126.80 - 128.30. => May sound good even you expose them overnight. Bought 124.60 sold 125.20 made +0.60.

Bears: In waiting mode.

10:40 AM

May be safe to close profited long positions. Markets may go slightly red tomorrow. => Definitively a bad call.

Integrated Score from 11/23/2011: 1.20 + 0.60 = 1.80

1. EURUSD hourly looks bullish with a pennant formation. A beak out would target 1.3570. That development supports bullish stock markets.

2. SPY Daily shows numerous of indicators in bullish crossover and that says there remains room for the upside.

3. My Game Setting for Fr 12/02/2011

I expect some kind of continuous rally based on hopes before the Dec 8 ECB, Dec 9 Euro summit and Dec 13 FOMC. For my short term trading purpose my first care are the support 123.00 and the resistance zone 126.70-128.40.

Bulls: in action with first targets 126.70-128.40.

Bears: may have enough time to enjoy the short term hibernation.

11.30.2011

The Wednesday's Big Rallies Could Be The Landmark Of A Trend Change.

10:40 AM

May be safe to close profited long positions. Markets may go slightly red tomorrow.

~~~~~~~~~~~~~

What is standing behind the Wednesday's big gains?

According to Reuters: "...Major central banks agreed to make cheaper dollar loans for struggling European banks to prevent the euro-zone debt woes from turning into a full-blown credit crisis.

The central banks' actions were intended to ensure that European banks, facing a credit crunch, have enough funding amid the euro zone's worsening sovereign debt crisis.

The moves followed an unexpected cut in bank reserve requirements in China, intended to boost an economy running at its weakest pace since 2009.

Further encouraging investors, the latest U.S. data suggested the U.S. economy was moving more solidly toward recovery. The U.S. private sector added the most jobs in nearly a year in November, while business activity in the U.S. Midwest grew faster than expected in November..."

So what should be my lesson? Stock markets reflect the health and the fundamentals of the economy. The economy is affected by political developments, economic policies and social/economic events. The investors (institutions/money managers) they have their way to approach news faster than us the retailers. The way investors read the news makes the way markets move. My lesson tells me that I will never depend on purely technical analysis to boldly forecast the markets especially when they are in an oversold/overbought state.

Reviewing My Game Setting Tuesday

Reviewing My Game Setting Wednesday => I had canceled this setting before the market open.

Bears: Short 119.00-120.30 target 118.25-118.50

Aggressive Bears: Overnight exposure and target 116.32 - 116.82

10:47 AM

PSEC long settup: Price breaks out MA50 and trend channel, above Ichimoku Cloud. Stochastics and RSI9 crosse over.

I went long @9.11 => My setting makes score on this. It is an overnight position.

1. EURUSD Hourly: Is looking for the resistance 1.3567. When I posted before the open yesterday "EurUsd is sitting above 1.3407 and trying to beakout the rising wedge to make a reversal. It's price action certainly favors the bullish reading/setting of stock markets", a trader named Эрик from Seeking Alpha reminded me "If it does it will further form a cup and handle pattern". Oh yes, It's very probable. Thank you.

2. SPY Daily: Bears just need 3 days to reclaim all they had lent to Bears for 7 days. That says enough how eager and strong the Bulls are today, so Bears may be better to seek a hibernation for a week.

My Game Setting For Th 12/1/2011

I may think that markets will remain bullish till the end of the next week. Does this idea go a bit too far to a trader? Anyway, I will try to swiftly adjust my Game Setting according to the market signs. I think a pullback is a chance to buy at least for today.

Bulls: Buy on pullbacks. Target 126.80 - 128.30.

Bears: In waiting mode.

May be safe to close profited long positions. Markets may go slightly red tomorrow.

~~~~~~~~~~~~~

What is standing behind the Wednesday's big gains?

According to Reuters: "...Major central banks agreed to make cheaper dollar loans for struggling European banks to prevent the euro-zone debt woes from turning into a full-blown credit crisis.

The central banks' actions were intended to ensure that European banks, facing a credit crunch, have enough funding amid the euro zone's worsening sovereign debt crisis.

The moves followed an unexpected cut in bank reserve requirements in China, intended to boost an economy running at its weakest pace since 2009.

Further encouraging investors, the latest U.S. data suggested the U.S. economy was moving more solidly toward recovery. The U.S. private sector added the most jobs in nearly a year in November, while business activity in the U.S. Midwest grew faster than expected in November..."

So what should be my lesson? Stock markets reflect the health and the fundamentals of the economy. The economy is affected by political developments, economic policies and social/economic events. The investors (institutions/money managers) they have their way to approach news faster than us the retailers. The way investors read the news makes the way markets move. My lesson tells me that I will never depend on purely technical analysis to boldly forecast the markets especially when they are in an oversold/overbought state.

Reviewing My Game Setting Tuesday

..........

Bears: No Bears Setting because of today's "Euro Chiefs to Meet". I consider it a high risk for Bears. => So lucky this caution saves my Bears from loss from 3% gap up on Wednesday!Bears: Short 119.00-120.30 target 118.25-118.50

Aggressive Bears: Overnight exposure and target 116.32 - 116.82

10:47 AM

PSEC long settup: Price breaks out MA50 and trend channel, above Ichimoku Cloud. Stochastics and RSI9 crosse over.

I went long @9.11 => My setting makes score on this. It is an overnight position.

1. EURUSD Hourly: Is looking for the resistance 1.3567. When I posted before the open yesterday "EurUsd is sitting above 1.3407 and trying to beakout the rising wedge to make a reversal. It's price action certainly favors the bullish reading/setting of stock markets", a trader named Эрик from Seeking Alpha reminded me "If it does it will further form a cup and handle pattern". Oh yes, It's very probable. Thank you.

2. SPY Daily: Bears just need 3 days to reclaim all they had lent to Bears for 7 days. That says enough how eager and strong the Bulls are today, so Bears may be better to seek a hibernation for a week.

My Game Setting For Th 12/1/2011

I may think that markets will remain bullish till the end of the next week. Does this idea go a bit too far to a trader? Anyway, I will try to swiftly adjust my Game Setting according to the market signs. I think a pullback is a chance to buy at least for today.

Bulls: Buy on pullbacks. Target 126.80 - 128.30.

Bears: In waiting mode.

11.29.2011

A stalemate in finding solutions for Eurozone Debts was seen and I expect a few red days comming

Reviewing My Game Setting Tuesday

Bulls may try to test 121-121.5 first and at that levels Bears may resume their battle.

Bulls: Limit the target at 121-121.5. May even consider to lower it down to 120.70 if it gonna be unfavorable. => It was a good call, Bulls had many chances to sell at 120.70.

The Setting is worth to get +0.70 credit score if it said "Buy below the 120...".

Bears: No Bears Setting because of today's "Euro Chiefs to Meet". I consider it a high risk for Bears.

Integrated Score from 11.23.2011: 1.20 (unchanged meanwhile it should be getting additional +0.70).

Market Outlook for Wednesday 11/30/2011

2. EURUSD daily shows heavy the selling pressure at 1.3407.

3. EURUSD hourly: Seems a rising wedge was formed and broken at 1.3317 at 2:00 AM that says the downward continuation trend is at higher odds than the reversal and that resumes downward pressure on stock markets.

4. SPY daily: Bulls was unable to win the 121.xx and 121 seems the goodbye kissing in short term. My reading favors a red day today.

5. My Game Setting

Bears: Short 119.00-120.30 target 118.25-118.50

Aggressive Bears: Overnight exposure and target 116.32 - 116.82

8:14 AM

EurUsd is sitting above 1.3407 and trying to beakout the rising wedge to make a reversal. It's price action certainly favors the bullish reading/setting of stock markets.

Update my Game Setting: Nullification of the above setting because I don't know what standing behind this pre-market huge rally.

8:32 AM

I need time to digest what they say "China move gives Europe stocks a boost". Anyway chasing a huge move up is risky.

I may be a short term trend follower to buy the intraday pullback for day trade.

10:47 AM

PSEC long settup: Price breaks out MA50 and trend channel, above Ichimoku Cloud. Stochastics and RSI9 crosse over.

I went long @9.11

Bulls may try to test 121-121.5 first and at that levels Bears may resume their battle.

Bulls: Limit the target at 121-121.5. May even consider to lower it down to 120.70 if it gonna be unfavorable. => It was a good call, Bulls had many chances to sell at 120.70.

The Setting is worth to get +0.70 credit score if it said "Buy below the 120...".

Bears: No Bears Setting because of today's "Euro Chiefs to Meet". I consider it a high risk for Bears.

Integrated Score from 11.23.2011: 1.20 (unchanged meanwhile it should be getting additional +0.70).

Market Outlook for Wednesday 11/30/2011

2. EURUSD daily shows heavy the selling pressure at 1.3407.

3. EURUSD hourly: Seems a rising wedge was formed and broken at 1.3317 at 2:00 AM that says the downward continuation trend is at higher odds than the reversal and that resumes downward pressure on stock markets.

4. SPY daily: Bulls was unable to win the 121.xx and 121 seems the goodbye kissing in short term. My reading favors a red day today.

5. My Game Setting

Bears: Short 119.00-120.30 target 118.25-118.50

Aggressive Bears: Overnight exposure and target 116.32 - 116.82

8:14 AM

EurUsd is sitting above 1.3407 and trying to beakout the rising wedge to make a reversal. It's price action certainly favors the bullish reading/setting of stock markets.

Update my Game Setting: Nullification of the above setting because I don't know what standing behind this pre-market huge rally.

8:32 AM

I need time to digest what they say "China move gives Europe stocks a boost". Anyway chasing a huge move up is risky.

I may be a short term trend follower to buy the intraday pullback for day trade.

10:47 AM

PSEC long settup: Price breaks out MA50 and trend channel, above Ichimoku Cloud. Stochastics and RSI9 crosse over.

I went long @9.11

Subscribe to:

Posts (Atom)