Yesterday's drop and the last 15min's retreat look bad for bulls. However bulls still hold some hopes when prices closed the day above the key support level 1400.00.

Markets today will be decided by what Mr. Bernanke is going to hint in Jackson Hole.

I expect the resistance [1404.64-1405.59] and support [1397.00-1400.00] are firmed before the Bernanke's keynote speech. After the speech, we'll see one of these be taken away.

The next target of bears after breakdown: 1382.00-1384.00 and the target for bulls after breakout: 1414.60-1416.20.

8.31.2012

8.30.2012

Expecting the third range day?

As prices closed the day above 1408.50, I continue to expect a positive closing today.

A bullish symmetrical triangle is forming on the 15min chart. The support would happen at the third contact of the prices with the upward slant.

Unaware of the bullish symmetrical triangle, bulls need to challenge the target 1414.60-1416.20 before doing the next one at 1420.60-1423.40.

The bearish scenario would target 1403.00-1405.59 before making the next low.

A bullish symmetrical triangle is forming on the 15min chart. The support would happen at the third contact of the prices with the upward slant.

Unaware of the bullish symmetrical triangle, bulls need to challenge the target 1414.60-1416.20 before doing the next one at 1420.60-1423.40.

The bearish scenario would target 1403.00-1405.59 before making the next low.

8.29.2012

Another range day?

Prices were sandwiched yesterday in the zone and whipsawed (volatile) between green and red areas as I anticipated.

As prices closed the day above 1408.50, I expect a positive closing today. Bulls need to challenge the target 1414.60-1416.20 before the next one at 1420.60-1423.40.

The bearish scenario would target 1403.00-1405.59 before the next low.

As prices closed the day above 1408.50, I expect a positive closing today. Bulls need to challenge the target 1414.60-1416.20 before the next one at 1420.60-1423.40.

The bearish scenario would target 1403.00-1405.59 before the next low.

8.28.2012

1408.50 may be an important level

Not much change yesterday when bulls closed the day almost the same as they began the day after trying the first target area 1415.75 +/-0.50 and respected it.

There might be a possibility that prices will be high volatile today when they are traded in the sandwich defined by 1404.00-1405.44 as support and 1415.75 +/-0.50 as resistance area.

A level that may be important is 1408.50. It is the scope for today of the major down-trend line connecting highs of 10/11/2007 and 4/2/2012. I suspect that a close today above the 1408.50 is good for bulls at least for the next day. A close below 1408.50 would favor bears.

EUR/USD outbreaks today from the falling wedge to test the recent high may be a good sign for stocks and gold.

There might be a possibility that prices will be high volatile today when they are traded in the sandwich defined by 1404.00-1405.44 as support and 1415.75 +/-0.50 as resistance area.

A level that may be important is 1408.50. It is the scope for today of the major down-trend line connecting highs of 10/11/2007 and 4/2/2012. I suspect that a close today above the 1408.50 is good for bulls at least for the next day. A close below 1408.50 would favor bears.

EUR/USD outbreaks today from the falling wedge to test the recent high may be a good sign for stocks and gold.

8.27.2012

Bulls may try to get 1415.75 before 1420.60-1423.40

SPX

I expect bulls will try to get 1415.75 +/-0.50 for today. If close of the day is at or above this level, the next target would be 1420.60-1423.40.

For the bearish scenario, the successive target may be 1404.00-1405.44 and 1395.00.

GOLD

Gold broke the rising triangle four days ago and is trying to win 1674.47. Gold is now 3 days above the major bearish trend line since the high of Sep 06, 2011 - a sign of bullish. If gold can win 1674.47, next target may be 1690.00. Gold bullish may favor stock markets.

I expect bulls will try to get 1415.75 +/-0.50 for today. If close of the day is at or above this level, the next target would be 1420.60-1423.40.

For the bearish scenario, the successive target may be 1404.00-1405.44 and 1395.00.

GOLD

Gold broke the rising triangle four days ago and is trying to win 1674.47. Gold is now 3 days above the major bearish trend line since the high of Sep 06, 2011 - a sign of bullish. If gold can win 1674.47, next target may be 1690.00. Gold bullish may favor stock markets.

8.24.2012

The key support level for bulls would be 1400.00

1400.00 would be a key support level for bulls. If 1400.00 holds, the bull's first target would be 1411.15-1415.00.

For the downside scenario, if 1400.00 fails to hold, the bear's first target would be 1394.50 before the second target in the area 1382.00-1384.00.

For the downside scenario, if 1400.00 fails to hold, the bear's first target would be 1394.50 before the second target in the area 1382.00-1384.00.

8.23.2012

Not going against FED, I expect that bulls will advance today to test the high 1426.68

10.54am Update

Bulls need more patience than aggressiveness. Some indicators show cross-down and hesitance. At least some more consolidation before up or down. Break out the range 1403.00-1416.50 need to be seen before adding long or short. I still favor bull, however with more cautiousness.

~~~~~~~~~~~~~~~~~~

The index made a nice bounce at the contact with the second support area 1404.64-1407.20. The bounce can be explained supported by FOMC Meeting Minutes which favors the prospect of further easing by the Fed next month.

Not going against FED, I expect that bulls will advance today to test the recent high 1426.68. A little hesitation or a small pullback there, may be, then I expect a breakout by late today or by tomorrow.

EUR/USD

I supposed you esteemed visitors remember my post 8/21/2012 where I expected the level 1.2550 -1.2600 would be visited.

The next move of the pair would be the upper major trend line (yellow) at around 1.27xx. Imagine! That if happens, will support the equities markets

Bulls need more patience than aggressiveness. Some indicators show cross-down and hesitance. At least some more consolidation before up or down. Break out the range 1403.00-1416.50 need to be seen before adding long or short. I still favor bull, however with more cautiousness.

~~~~~~~~~~~~~~~~~~

The index made a nice bounce at the contact with the second support area 1404.64-1407.20. The bounce can be explained supported by FOMC Meeting Minutes which favors the prospect of further easing by the Fed next month.

Not going against FED, I expect that bulls will advance today to test the recent high 1426.68. A little hesitation or a small pullback there, may be, then I expect a breakout by late today or by tomorrow.

EUR/USD

I supposed you esteemed visitors remember my post 8/21/2012 where I expected the level 1.2550 -1.2600 would be visited.

The next move of the pair would be the upper major trend line (yellow) at around 1.27xx. Imagine! That if happens, will support the equities markets

8.22.2012

Even a pullback may continue today, I expect to see higher highs soon

The index had successfully made a new high for four years, however the profit-taking (probably) had sent it back to the first support area 1412.00-1413.00.

If the pullback continues today, it is expected that the second support area 1404.64-1407.20 would work.

The level 1400.00 as it is the confluence of the trend line and Fib 38.2% should be a very solid support level for bulls.

As I told in the latest post, after making a new high, the market is expected to make higher highs ahead.

If the pullback continues today, it is expected that the second support area 1404.64-1407.20 would work.

The level 1400.00 as it is the confluence of the trend line and Fib 38.2% should be a very solid support level for bulls.

As I told in the latest post, after making a new high, the market is expected to make higher highs ahead.

8.21.2012

EUR/USD spikes today will favor the rise of the market and the first short-term target 1425.00 will be the answer of today or tomorrow

If I free up my imagination, I may want to answer Yes to the question: Can EUR climb up to 1.2550 -1.2600 to contact the top of the wedge/channel?

I have been repeating few times these days the target 1425 of the market. I suspect that this is just the first target and we may be prepared to see a next target higher.

If 1425 defeated, no more (B) or {2} and the rise from 1329.24 would be a motive part of a 5-wave structure.

Very small invest, but I'm long the market http://cyclestockmarketwinner.blogspot.com/p/trading-archive.html

I am not planing to short (front-run) this market when the target arrived.

I have been repeating few times these days the target 1425 of the market. I suspect that this is just the first target and we may be prepared to see a next target higher.

If 1425 defeated, no more (B) or {2} and the rise from 1329.24 would be a motive part of a 5-wave structure.

Very small invest, but I'm long the market http://cyclestockmarketwinner.blogspot.com/p/trading-archive.html

I am not planing to short (front-run) this market when the target arrived.

8.20.2012

Short term target maintains 1425

11.24am Update

Stock pick: LINE a fundamental stock with Cup with Handle Bullish Chart Pattern.

It looks as some indicators are showing kind of overbought. However, not all of them are overbought and none of them is getting extreme. I expect there is still more room ahead for bulls.

Meanwhile EW fans may consider the rally from 1266.74 to 1391.74 as counter trend, characterized by overlapping and vulnerable to a massive fall, I suspected that the rise from 1329.24 may be a motive part of a 5-wave structure. I need to see the index wins 1422.38, holds and makes new high to confirm my assumption.

Today I will consider a pullback if any to the area 1412.00-1413.00 as buy. The next support area would be 1404.64-1407.20. The first target would be 1425.00 as mentioned. Short is not an action in my plan.

Stock pick: LINE a fundamental stock with Cup with Handle Bullish Chart Pattern.

It looks as some indicators are showing kind of overbought. However, not all of them are overbought and none of them is getting extreme. I expect there is still more room ahead for bulls.

Meanwhile EW fans may consider the rally from 1266.74 to 1391.74 as counter trend, characterized by overlapping and vulnerable to a massive fall, I suspected that the rise from 1329.24 may be a motive part of a 5-wave structure. I need to see the index wins 1422.38, holds and makes new high to confirm my assumption.

Today I will consider a pullback if any to the area 1412.00-1413.00 as buy. The next support area would be 1404.64-1407.20. The first target would be 1425.00 as mentioned. Short is not an action in my plan.

8.17.2012

A pullback if any may be bought for the 1420 and 1425 targets

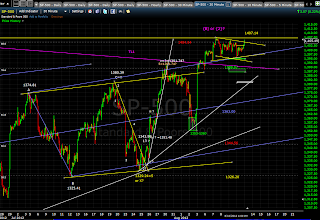

Price had successfully pierced out the symmetrical triangle top/pennant and then the rising

channel. That is very bullish and I expect that price will manage

to challenge next targets at 1420.00 and 1425.00.

However, it also seems to me that

the market was in an overbought conditions and a pullback may be seen before the above mentioned targets.

I am prepared to buy a pullback and suggest 1410.00 as the first support. The second support would be in the area 1402.50-1406.20.

8.16.2012

Seems a baby symmetrical triangle top/pennant seen above a mother symmetrical triangle top/pennant. That suggests bulls might try 1412.00

12.20pm Update

May be the top of the day (intraday top) is imminent. I suggest somewhere around 1414.07.

Only recommended for closing the long positions.

~~~~~~~~~~~~~~~~~

Looks like a baby symmetrical triangle top/pennant (blue color) sitting above the mother symmetrical triangle top/pennant (yellow). All of them are inside a rising channel favoring the idea that bulls would like to try the upper side for next moves.

Yesterday's small gap down was bought and it has been 4 days we see higher lows.

If price breaks out the baby pennant, the order of resistances bulls would try will be 1410.03, 1412.00 and 1414.30 before the target 1420.00.

For the bearish scenario the 1st support would be 1341.50 before a stronger support in the area 1396.96-1399.66 and the strongest 1388.97.

May be the top of the day (intraday top) is imminent. I suggest somewhere around 1414.07.

Only recommended for closing the long positions.

~~~~~~~~~~~~~~~~~

Looks like a baby symmetrical triangle top/pennant (blue color) sitting above the mother symmetrical triangle top/pennant (yellow). All of them are inside a rising channel favoring the idea that bulls would like to try the upper side for next moves.

Yesterday's small gap down was bought and it has been 4 days we see higher lows.

If price breaks out the baby pennant, the order of resistances bulls would try will be 1410.03, 1412.00 and 1414.30 before the target 1420.00.

For the bearish scenario the 1st support would be 1341.50 before a stronger support in the area 1396.96-1399.66 and the strongest 1388.97.

8.15.2012

Today I care 1396.96 and 1411.00

Yesterday bulls broke out the symmetrical triangle top and made a higher high after six days fighting. The pullback seen after the high might be a result of profits taking. Market remains in cautiously bullish.

If bulls can make another push up, the resistance at 1411.00 might work.

In case of a pullback, I would like to pay attention to the 1st support at 1396.96. If bears could go further, next support would be 1394.00 and finally 1388.87 would be a very solid support in case of a hard drop as it is a confluence of a number of Fibonacci levels and trend lines.

If bulls can make another push up, the resistance at 1411.00 might work.

In case of a pullback, I would like to pay attention to the 1st support at 1396.96. If bears could go further, next support would be 1394.00 and finally 1388.87 would be a very solid support in case of a hard drop as it is a confluence of a number of Fibonacci levels and trend lines.

8.14.2012

The market remains in cautiously bullish until bulls win 1407.14 or bears win 1387.09

Yesterday was another day of buy on dip.

Price got 4 times testing the upper line of the symmetrical triangle top during 5 trading days. That looks bullish to me.

If bulls win 1407.14 in next 2 trading days, I guess market will be very bullish next.

If bears win 1387.09 in next 2 trading days, on the other hand, market will turn to bearish at least for short term.

Price got 4 times testing the upper line of the symmetrical triangle top during 5 trading days. That looks bullish to me.

If bulls win 1407.14 in next 2 trading days, I guess market will be very bullish next.

If bears win 1387.09 in next 2 trading days, on the other hand, market will turn to bearish at least for short term.

8.12.2012

The market is cautiously bullish

12.17pm Update (Day-Trade)

Up through 1400 would be long and.

Down below 1397.30 would be short.

6.45am Update

I am watching the 30min chart, it seems that price was trying a break out of the upper line of a bull flag or a symmetrical triangle top.

~~~~~~~~~~~~~~~~

The market is cautiously bullish and until I see a smash down deeper than 0.5%, I still expect buying the pullback would be win.

We can see a series of higher highs since the low at 1266.74 and the very important bearish trend-line connecting 1422.38 with 1414.48 had been broken to the upside. For the 5 consecutive days dips had been bough and bulls had been inching up.

Because Elliot Wave interprets price's overlap since 1266.74 as counter trend rally and the counting of a triple-zigzag may be ending, I will change my short-term bullish view when I see the 1391.74 is taken away by bears.

If 1391.74 is break down, then I expect 1381.00 hold. If 1381.00 is break down, I will try to short the market on bounce for the first target of 1366.24.

Up through 1400 would be long and.

Down below 1397.30 would be short.

6.45am Update

I am watching the 30min chart, it seems that price was trying a break out of the upper line of a bull flag or a symmetrical triangle top.

~~~~~~~~~~~~~~~~

The market is cautiously bullish and until I see a smash down deeper than 0.5%, I still expect buying the pullback would be win.

We can see a series of higher highs since the low at 1266.74 and the very important bearish trend-line connecting 1422.38 with 1414.48 had been broken to the upside. For the 5 consecutive days dips had been bough and bulls had been inching up.

Because Elliot Wave interprets price's overlap since 1266.74 as counter trend rally and the counting of a triple-zigzag may be ending, I will change my short-term bullish view when I see the 1391.74 is taken away by bears.

If 1391.74 is break down, then I expect 1381.00 hold. If 1381.00 is break down, I will try to short the market on bounce for the first target of 1366.24.

8.01.2012

Market may try to make a final short term rebound

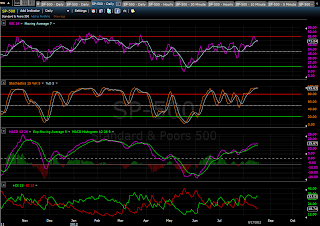

Watching the hourly chart with MACD, I tend to think that the short term top was in and we may be about to see a drop soon. The safe moment to short may be and may be after 8:30am Thursday, the ECB Press Conference.

Meanwhile the 15min chart with EW count and falling wedge formation tends to say that a final wave-5 up is about to unfold right now. The best target may be in the area 1394.50-1403.00.

(If market cannot beak out the wedge and falls, it may confirm the counting that wave-5 was in as showed by the orange figures in the chart).

Meanwhile the 15min chart with EW count and falling wedge formation tends to say that a final wave-5 up is about to unfold right now. The best target may be in the area 1394.50-1403.00.

(If market cannot beak out the wedge and falls, it may confirm the counting that wave-5 was in as showed by the orange figures in the chart).

Subscribe to:

Posts (Atom)