While all my readings tend to continues the bullish, I did closed all my longs (BAK, WYNN, HL, SKM, TWO & KWK) acording to my observation last 2 days "Sell the gap up/rally buy the dip". It is okay and not worth a blame.

However, when I saw some weakness in Europe markets with "a probable top" haunted my mind, I let my bears took risks with a pilot short and

I got a fine bill sent to my bears who tried to run before the green sign.

11:39 AM

If you want a pilot short, you may want to use the proxy TVIX? I did.

11:05 AM

Sold out all on rally and will buy back on dip.

5:33 AM

Paid your attention to the possibility to form a diamond bottoms reversal pattern, which might lead to a huge rebound of EURUSD and that in turn favors stock markets.

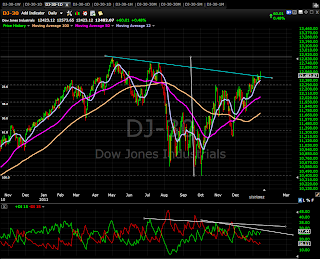

Nasdaq-100 and DJ-30 broke up the final bearish trend lines, could they hold it?

SPY looks to follow a rising channel and seemingly wants to win the final bearish trend line at about 131.40.

Trading setup for 1/18/2012

I am awaiting 131.40 to be broken up by SPY to confirm an absolute state of US bullish markets. However, the intraday development showed interests to sell at high prices. That pull me back to an indecision mode.

Apparently, sell the gap up and buy the dip is what active traders are making profits these days.

No comments:

Post a Comment