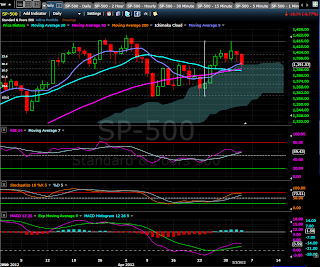

SPX next 3 weeks with traditional view

I think problems of Europe especially the uncertainty of Greece as an Euro-zone member and Spain's banks reform will keep the price under 1339.xx.

The US economic recovery combining with the 200days-MA will act as a strong support until the Greece's June 17 election.

Trading idea

Markets showed high volatility these days and my cautious view says that until the price can clear out the zone [1282.xx - 1339.xx] for a new trend (up) established or the old trend (down) resuming, trading is very short-term and high-risk.

5.27.2012

5.25.2012

SPX

Traditional view (daily)

Looks bullish with crossover signals on Price/MA9, RSI, Stochastics and bottom-forming view on MACD

Elliott Views

Bearish case: Probably that the (a)(b)(c) waves of the correction move will come truth with wave (c) ended at somewhere between 1328.xx - 1339.xx. The downward move must resume to break down 1291.98 after wave (c).

Bullish case: If 1339.11 is broken out, then the ABC had ended at 1291.98 (dated 5/18) and I may count (1?)(2?)(3?)... as components inside the wave 3 up that began from 12.30 (5/23).

Traditional view (daily)

Looks bullish with crossover signals on Price/MA9, RSI, Stochastics and bottom-forming view on MACD

Elliott Views

Bearish case: Probably that the (a)(b)(c) waves of the correction move will come truth with wave (c) ended at somewhere between 1328.xx - 1339.xx. The downward move must resume to break down 1291.98 after wave (c).

Bullish case: If 1339.11 is broken out, then the ABC had ended at 1291.98 (dated 5/18) and I may count (1?)(2?)(3?)... as components inside the wave 3 up that began from 12.30 (5/23).

5.24.2012

It seems that I was right when granted 51% to the possibility of an (a)(b)(c) correction move instead of the possibility that wave 4 had ended at 1328.49.

SPX

With yesterday's afternoon green bounce when price couldn't break down the trend line (red). It seems that I was right when granted 51% to the possibility of an (a)(b)(c) correction move instead of the possibility that wave 4 had ended at 1328.49.

However this (a)(b)(c) correction move needs to be confirmed by leaving it's trace at somewhere between 1328.xx - 1339.xx.

There still a smaller possibility that price would go down to break 1291.98 from yesterday's close or from a level lower than 1328.49 and I have to be prepared for this.

My Trading Plan

I would consider to go long for today.

With yesterday's afternoon green bounce when price couldn't break down the trend line (red). It seems that I was right when granted 51% to the possibility of an (a)(b)(c) correction move instead of the possibility that wave 4 had ended at 1328.49.

However this (a)(b)(c) correction move needs to be confirmed by leaving it's trace at somewhere between 1328.xx - 1339.xx.

There still a smaller possibility that price would go down to break 1291.98 from yesterday's close or from a level lower than 1328.49 and I have to be prepared for this.

My Trading Plan

I would consider to go long for today.

5.23.2012

It is 51% that the bounce will make an (a)(b)(c) pattern

SPX

It is 51% that the bounce will make an (a)(b)(c) pattern and (b) is where the price makes contact with the red trend line, (c) will be somewhere between 1328.xx - 1339.xx.

And 49% is that the bounce has finished at 1328.49 (wave 4 end) and price will try to make lower low than 1291.98. This move if happens will form the wave 5 inside the wave (III) of the correction wave C. My target in this scenario for wave 5 would be 1270.xx.

It is 51% that the bounce will make an (a)(b)(c) pattern and (b) is where the price makes contact with the red trend line, (c) will be somewhere between 1328.xx - 1339.xx.

And 49% is that the bounce has finished at 1328.49 (wave 4 end) and price will try to make lower low than 1291.98. This move if happens will form the wave 5 inside the wave (III) of the correction wave C. My target in this scenario for wave 5 would be 1270.xx.

5.22.2012

Expecting that the bounce will continue until resistance zone [1328.xx - 1339.xx] is visited.

SPX

Expecting that the bounce will continue, so a pullback will be a buy opportunity until resistance zone [1328.xx - 1339.xx] is visited.

This bounce will form the wave 4 inside the wave (III) of the correction wave C. It means that the downward move will be resumed once this wave 4 ended.

Expecting that the bounce will continue, so a pullback will be a buy opportunity until resistance zone [1328.xx - 1339.xx] is visited.

This bounce will form the wave 4 inside the wave (III) of the correction wave C. It means that the downward move will be resumed once this wave 4 ended.

5.20.2012

The price of SPX is just an inch above the important support zone and I expect to see a bounce next Monday or Tuesday

Markets are deeply oversold

Seems there is a consensus among bloggers about an imminent bounce when most of indicators are in oversold territory.

When T2108 is under 20, It is highly probable we'll see a rebound. The price of SPX is just an inch above the important support zone and I expect to see a bounce next Monday or Tuesday. The bounce this time will be strong enough to keep indexes in green.

My Trading Plan

I expect next contact of price with lower line of the descending channel (violet) would be the end of Wave 3. So a contact with the lower-line would be a BUY with awareness that this is a high-risk/reward trade.

A safer trade setting would be waiting for price to break out the upper-line of the channel before a BUY.

1320.xx (Fib38.2) may be safe for bulls in case of a bounce.

Seems there is a consensus among bloggers about an imminent bounce when most of indicators are in oversold territory.

When T2108 is under 20, It is highly probable we'll see a rebound. The price of SPX is just an inch above the important support zone and I expect to see a bounce next Monday or Tuesday. The bounce this time will be strong enough to keep indexes in green.

My Trading Plan

I expect next contact of price with lower line of the descending channel (violet) would be the end of Wave 3. So a contact with the lower-line would be a BUY with awareness that this is a high-risk/reward trade.

A safer trade setting would be waiting for price to break out the upper-line of the channel before a BUY.

1320.xx (Fib38.2) may be safe for bulls in case of a bounce.

5.18.2012

The strong supports 1278.xx - 1289.xx are near

SPX daily

I can see a strong support zone [1278.xx - 1289.xx] combined by the Fib 38.2 and the MA200 is near below the current price.

The question is whether market will make a bounce first and visit this support zone later or it will do the opposite?

I still have no answer yet. But what I seemed notice from the global markets is the index will not able to print itself in green if DAX and CAC 40 are dipped more than -0.50%.

My trading plan on the chart

I would like to apply the same tactics that proved working well yesterday.

Long or short depending on the direction of the price.

Long if price can break out the down-slope violet line.

Short if this violet line remains intact.

I can see a strong support zone [1278.xx - 1289.xx] combined by the Fib 38.2 and the MA200 is near below the current price.

The question is whether market will make a bounce first and visit this support zone later or it will do the opposite?

I still have no answer yet. But what I seemed notice from the global markets is the index will not able to print itself in green if DAX and CAC 40 are dipped more than -0.50%.

My trading plan on the chart

I would like to apply the same tactics that proved working well yesterday.

Long or short depending on the direction of the price.

Long if price can break out the down-slope violet line.

Short if this violet line remains intact.

5.17.2012

More downs ahead and a question is timing and degree of a bounce

SPX

I expect more downs ahead when my target 1312 is still to meet.

As I don't see any meaningful bounce during last 11 bearish days, I suspect it is around.

Combining these two things I decide not to hold shorts overnight until I could short from near the top of a meaningful bounce.

I present some trading cases in the chart:

5.14.2012

My favorite scenario for next two or three days is a bounce trading that respects the resistance 1354.xx before a strong selling resumed.

SPX Elliott bearish view

My favorite scenario for next two or three days is a bounce trading that respects the resistance 1354.xx before a strong selling resumed.

With yesterday's low at 1336.72, I believe that the wave (III) of wave C of ABC correction mode from the top 1422.38 is underway.

The bounce if any is expected short-lived and might be the forming of wave 2 (after wave 1) of the wave (III). If this count becomes truth, the wave (III) will be the most destructive wave of the correction process.

My favorite scenario for next two or three days is a bounce trading that respects the resistance 1354.xx before a strong selling resumed.

With yesterday's low at 1336.72, I believe that the wave (III) of wave C of ABC correction mode from the top 1422.38 is underway.

The bounce if any is expected short-lived and might be the forming of wave 2 (after wave 1) of the wave (III). If this count becomes truth, the wave (III) will be the most destructive wave of the correction process.

5.13.2012

A bounce to break the box ceiling?

6.34am update

A sharp drop in SPX seen at this moment seems to disable the possibility of a bounce. 1343.13 - the bottom of the box might be broken today. If this is the case, bounces will be chances to sell.

SPX daily traditional view

A sharp drop in SPX seen at this moment seems to disable the possibility of a bounce. 1343.13 - the bottom of the box might be broken today. If this is the case, bounces will be chances to sell.

SPX daily traditional view

Overall picture remains bearish. However, because no important bounce found during last 8 bearish days and bears could'n make new low for last 3 days, it may be time to speculate about a bounce that is strong enough to keep at least one day in green.

A bounce to break the box ceiling? If it happens, it may be a break out of an ascending triangle to form a bear flag. In this case bulls may target 1370.80 - 1379.40.

If a dip day on Monday, I think the best bears can do is to visit 1343.13 the low of last 3 days.

Elliot bearish view

A bounce if any is only to make the wave c of the abc counter trend move to end the wave (II) for the beginning of wave (III) down. This is considered as an aggressive bearish count.

5.11.2012

It may be a range trading day. Bears may try to push down to test 1343.xx but Bulls will buy the dip and a bounce could be seen. Bounce today if any would be limited by 1365.xx.

SPX

It may be a range trading day. Bears may try to push down to test 1343.xx but Bulls will buy the dip and a bounce could be seen. Bounce today if any would be limited by 1365.xx.

My speculation is a breaking out the box to the upper side next Monday and probably it would be a Bull Trap.

It may be a range trading day. Bears may try to push down to test 1343.xx but Bulls will buy the dip and a bounce could be seen. Bounce today if any would be limited by 1365.xx.

My speculation is a breaking out the box to the upper side next Monday and probably it would be a Bull Trap.

5.10.2012

A rebound if any may be short lived

SPX Traditional view

The daily chart looks ugly! More downside expected.

The two hammers beside each other hints a very short-term rebound. However I personally expect any rebound would be short-lived.

Target of a bounce may be around 1370.80.

Elliot bearish view

There may be a bounce to 1370.xx to form an abc counter-trend waves pattern of the wave (II). This count needs that the bounce happening above 1343.13.

The daily chart looks ugly! More downside expected.

The two hammers beside each other hints a very short-term rebound. However I personally expect any rebound would be short-lived.

Target of a bounce may be around 1370.80.

Elliot bearish view

There may be a bounce to 1370.xx to form an abc counter-trend waves pattern of the wave (II). This count needs that the bounce happening above 1343.13.

5.09.2012

We may see an unsuccessful pullback to test 1347.75 then a rebound to test 1374.xx

SPX

My preferred scenario based on Elliott Waves is an unsuccessful pullback to test 1347.75 and a rebound next to test 1374.xx.

The pivot moment might be about 12.30pm.

(I'm glad to see my evaluated resistance 1363.94 for yesterday's bounce took effect)

My preferred scenario based on Elliott Waves is an unsuccessful pullback to test 1347.75 and a rebound next to test 1374.xx.

The pivot moment might be about 12.30pm.

(I'm glad to see my evaluated resistance 1363.94 for yesterday's bounce took effect)

5.08.2012

The rebound on Monday looked too weak and if it resumes Tuesday before touching 1357.xx-1358.xx, it would be a good chance to short...

12.20pm

Looks like the first wave (I) of the C (- the 3rd wave of the corrective ABC) has completed with a 5 waves motive down pattern at 1347.75. If that is real, the second wave (II) would be underway with the intraday bounce. The 1st target of the bounce would be 1363.94.

My Trading System should turn to short at "appropriated" bounce targets. Saying differently, I don't believe any bounce as profitable before bears win 1312.xx.

SPX

My technical views with Traditional and Elliott angles are not changed from yesterday post.

In the short term view, I would like to add more bearishness to the picture because of the fact that the rebound on Monday looked too weak and if it resumes Tuesday before touching 1357.xx-1358.xx, it would be a good chance to short.

A rebound, if any today before touching 1357.xx-1358.xx, should be capped by 1376.xx.

Would like to repeat what I said yesterday "May be a profitable bounce can only be found at 1357.xx -1358.xx"

My note on the chart: When these 5 waves (of the Wave I of the corrective C) finish, we will see a profitable bounce.

Trading

A rebound Tuesday before touching 1357.xx-1358.xx would be a good chance to short.

A rebound Tuesday after touching 1357.xx-1358.xx would be a chance to long (counter trend, short-lived expectation).

Looks like the first wave (I) of the C (- the 3rd wave of the corrective ABC) has completed with a 5 waves motive down pattern at 1347.75. If that is real, the second wave (II) would be underway with the intraday bounce. The 1st target of the bounce would be 1363.94.

My Trading System should turn to short at "appropriated" bounce targets. Saying differently, I don't believe any bounce as profitable before bears win 1312.xx.

SPX

My technical views with Traditional and Elliott angles are not changed from yesterday post.

In the short term view, I would like to add more bearishness to the picture because of the fact that the rebound on Monday looked too weak and if it resumes Tuesday before touching 1357.xx-1358.xx, it would be a good chance to short.

A rebound, if any today before touching 1357.xx-1358.xx, should be capped by 1376.xx.

Would like to repeat what I said yesterday "May be a profitable bounce can only be found at 1357.xx -1358.xx"

My note on the chart: When these 5 waves (of the Wave I of the corrective C) finish, we will see a profitable bounce.

Trading

A rebound Tuesday before touching 1357.xx-1358.xx would be a good chance to short.

A rebound Tuesday after touching 1357.xx-1358.xx would be a chance to long (counter trend, short-lived expectation).

5.07.2012

A profitable bounce is imminent. However more down ahead is expected

SPX traditional view

All targets of the sells (the Rising Wedge 1380.xx and the H&S 1372.xx) met. I speculated a bounce targeted 1380.xx at 13.03pm when SPX was at 1370.0x. However it didn't happen. It was a warning sign for my bulls. May be a profitable bounce can only be found at 1357.xx -1358.xx.

When we take a look at the daily chart we see many bearish factors are in:

Price crossed down the MA20 and MA50 and goes deeper into the Ichimoku Cloud.

RSI, Stochastic and MACD are bearish crossover. The MACD Histogram revealed only the 1st red bar which implies that further downward movements will be seen.

For the trading with traditional view, a bounce will be considered as a chance to sell or short.

The Elliott bullish view

Need to see a big bounce on Monday before 1359.67 (the low of 4/23/12) and that bounce must lead to a huge up day next. I personally don't favor this view.

The Elliott bearish view

If 1357.38 (the low of 4/10/12) is not respected in next few days, the wave C of the correction ABC will be unveiled and I expect the next target of bears would be 1312.xx.

Trading

A continuous down day Monday would be a buy for aggressive bulls who play the rebound.

A rebound Monday would be considered limited and may offer chances to sell.

All targets of the sells (the Rising Wedge 1380.xx and the H&S 1372.xx) met. I speculated a bounce targeted 1380.xx at 13.03pm when SPX was at 1370.0x. However it didn't happen. It was a warning sign for my bulls. May be a profitable bounce can only be found at 1357.xx -1358.xx.

When we take a look at the daily chart we see many bearish factors are in:

Price crossed down the MA20 and MA50 and goes deeper into the Ichimoku Cloud.

RSI, Stochastic and MACD are bearish crossover. The MACD Histogram revealed only the 1st red bar which implies that further downward movements will be seen.

For the trading with traditional view, a bounce will be considered as a chance to sell or short.

The Elliott bullish view

Need to see a big bounce on Monday before 1359.67 (the low of 4/23/12) and that bounce must lead to a huge up day next. I personally don't favor this view.

The Elliott bearish view

If 1357.38 (the low of 4/10/12) is not respected in next few days, the wave C of the correction ABC will be unveiled and I expect the next target of bears would be 1312.xx.

Trading

A continuous down day Monday would be a buy for aggressive bulls who play the rebound.

A rebound Monday would be considered limited and may offer chances to sell.

5.03.2012

Expecting a further pullback? Different views show 1384.xx, 1380.xx, 1372.xx supports

13.03pm SPX@1370.0x

It might be the moment to get long for rebound playing. Target may be 1385.xx.

This play is for aggressive counter-trend players only.

=> My recalculation finds max target at 1380.xx not 1385.xx

Traditional view

A big rebound at 1384.xx is preferred and would say bull is healthy.

However, the textbook target of the Rising Wedge is 1380.xx

But the textbook target of this H&S pattern is 1372.xx.

The Elliott bullish view may think that an abc corrective (of the 5 waves up possibility that began since the low of 4/23) is done or about done and a rebound is imminent.

The Elliott bearish view is getting more feeds to the possibility that wave C (of the corrective waves ABC that initiated since the high of 4/2) is dawned.

It might be the moment to get long for rebound playing. Target may be 1385.xx.

This play is for aggressive counter-trend players only.

=> My recalculation finds max target at 1380.xx not 1385.xx

Traditional view

A big rebound at 1384.xx is preferred and would say bull is healthy.

However, the textbook target of the Rising Wedge is 1380.xx

But the textbook target of this H&S pattern is 1372.xx.

The Elliott bearish view is getting more feeds to the possibility that wave C (of the corrective waves ABC that initiated since the high of 4/2) is dawned.

A down slope of MACD and Signal Curve hints a further pullback.

Traditional view, some arguments for bears (Hourly chart)

Looks like a Bear Flag or a Rising Wedge. That all favors a formation of a H&S pattern.

A down slope of MACD and Signal Curve hints a further pullback (may be after a small push up).

Elliott very short-term bearish view

Expect a formation of an abc corrective pattern in a bullish scenario.

For longer time frames please review my last 2 posts

Looks like a Bear Flag or a Rising Wedge. That all favors a formation of a H&S pattern.

A down slope of MACD and Signal Curve hints a further pullback (may be after a small push up).

Elliott very short-term bearish view

Expect a formation of an abc corrective pattern in a bullish scenario.

For longer time frames please review my last 2 posts

5.02.2012

Any consolidation ahead or just a small pullback which offers buying chances?

Traditional view

The Tuesday green of the SPX add more bullish factors to the daily chart. However the pullback seen on the hourly chart that violated the high of the Friday 4/27/2012 shows that the 1415.xx might be a hard resistance zone and a further dip is opened.

With bullish arguments in hands, a pullback may be a buy if we can manage well the stop loss.

Elliott bearish view

As long as 1422.38 is not taken out by bulls, there is still a possibility the market to fall to make an ABC correction with destination lower than 1357.38. However, it seems that this possibility is becoming dimmer and dimmer.

Elliott bullish view

There may be some pullback to form wave 2 of the motive 5 waves up or a consolidation in the zone limited by the support 1386.00 and the resistance 1415.32 before a higher high would be made.

The Tuesday green of the SPX add more bullish factors to the daily chart. However the pullback seen on the hourly chart that violated the high of the Friday 4/27/2012 shows that the 1415.xx might be a hard resistance zone and a further dip is opened.

With bullish arguments in hands, a pullback may be a buy if we can manage well the stop loss.

Elliott bearish view

As long as 1422.38 is not taken out by bulls, there is still a possibility the market to fall to make an ABC correction with destination lower than 1357.38. However, it seems that this possibility is becoming dimmer and dimmer.

Elliott bullish view

There may be some pullback to form wave 2 of the motive 5 waves up or a consolidation in the zone limited by the support 1386.00 and the resistance 1415.32 before a higher high would be made.

5.01.2012

Might pullback go on to test 1384.xx?

Traditional view

Bullish in all aspects except that the pullback may continue and the rock support 1384.xx might be tested.

Elliott bearish view

Still opens the possibility to a further and steeper sink to form the wave C of the correction ABC which began from the April 3.

Elliot bullish view

The 5 days drop from the April 3 was just a deep pullback and it was not a part of an ABC correction. The rally began from the 4/24 might be the first motive of the five wave pattern up.

Trading

Aggressive bulls/bears may watch 1384.xx to go long (if unable to break down) or to go short (broken down).

Cautious bulls may want 1408.xx broken out to confirm long.

Cautious bears may want 1357.xx broken down to go short.

Bullish in all aspects except that the pullback may continue and the rock support 1384.xx might be tested.

Elliott bearish view

Still opens the possibility to a further and steeper sink to form the wave C of the correction ABC which began from the April 3.

Elliot bullish view

The 5 days drop from the April 3 was just a deep pullback and it was not a part of an ABC correction. The rally began from the 4/24 might be the first motive of the five wave pattern up.

Trading

Aggressive bulls/bears may watch 1384.xx to go long (if unable to break down) or to go short (broken down).

Cautious bulls may want 1408.xx broken out to confirm long.

Cautious bears may want 1357.xx broken down to go short.

Subscribe to:

Posts (Atom)