May be safe to close profited long positions. Markets may go slightly red tomorrow.

~~~~~~~~~~~~~

What is standing behind the Wednesday's big gains?

According to Reuters: "...Major central banks agreed to make cheaper dollar loans for struggling European banks to prevent the euro-zone debt woes from turning into a full-blown credit crisis.

The central banks' actions were intended to ensure that European banks, facing a credit crunch, have enough funding amid the euro zone's worsening sovereign debt crisis.

The moves followed an unexpected cut in bank reserve requirements in China, intended to boost an economy running at its weakest pace since 2009.

Further encouraging investors, the latest U.S. data suggested the U.S. economy was moving more solidly toward recovery. The U.S. private sector added the most jobs in nearly a year in November, while business activity in the U.S. Midwest grew faster than expected in November..."

So what should be my lesson? Stock markets reflect the health and the fundamentals of the economy. The economy is affected by political developments, economic policies and social/economic events. The investors (institutions/money managers) they have their way to approach news faster than us the retailers. The way investors read the news makes the way markets move. My lesson tells me that I will never depend on purely technical analysis to boldly forecast the markets especially when they are in an oversold/overbought state.

Reviewing My Game Setting Tuesday

..........

Bears: No Bears Setting because of today's "Euro Chiefs to Meet". I consider it a high risk for Bears. => So lucky this caution saves my Bears from loss from 3% gap up on Wednesday!Bears: Short 119.00-120.30 target 118.25-118.50

Aggressive Bears: Overnight exposure and target 116.32 - 116.82

10:47 AM

PSEC long settup: Price breaks out MA50 and trend channel, above Ichimoku Cloud. Stochastics and RSI9 crosse over.

I went long @9.11 => My setting makes score on this. It is an overnight position.

1. EURUSD Hourly: Is looking for the resistance 1.3567. When I posted before the open yesterday "EurUsd is sitting above 1.3407 and trying to beakout the rising wedge to make a reversal. It's price action certainly favors the bullish reading/setting of stock markets", a trader named Эрик from Seeking Alpha reminded me "If it does it will further form a cup and handle pattern". Oh yes, It's very probable. Thank you.

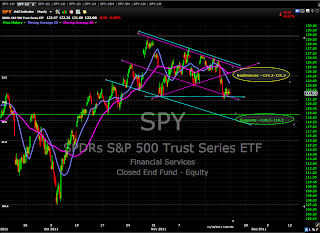

2. SPY Daily: Bears just need 3 days to reclaim all they had lent to Bears for 7 days. That says enough how eager and strong the Bulls are today, so Bears may be better to seek a hibernation for a week.

My Game Setting For Th 12/1/2011

I may think that markets will remain bullish till the end of the next week. Does this idea go a bit too far to a trader? Anyway, I will try to swiftly adjust my Game Setting according to the market signs. I think a pullback is a chance to buy at least for today.

Bulls: Buy on pullbacks. Target 126.80 - 128.30.

Bears: In waiting mode.